To Issue 139

Citation: Eldridge C, Shah O, “Climate Change and the Pharmaceutical Industry: Too Little, Too Late?”. ONdrugDelivery, Issue 139 (Oct/Nov 2022), pp 18–21.

Catriona Eldridge and Omar Shah discuss the findings of a recent investigative assessment into the environmental impact of healthcare products, and consider whether or not the pharmaceutical industry is doing enough to combat climate change.

“Despite having seemingly large environmental impacts, good early interventions, such as pMDIs, in fact avoid greater environmental damage by preventing more serious interventions later on.”

Governments and companies across the world have made ambitious commitments to reduce their environmental impact. For example, at the COP26 climate change conference in November 2021, 55 countries committed to developing low-carbon healthcare systems and 20 committed to developing net zero healthcare systems, with deadlines ranging from 2030 to 2050.1 What is the pharmaceutical industry doing to help meet these targets, and is it enough?

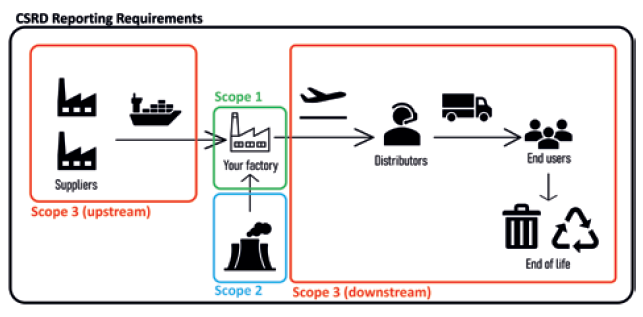

Governments are increasing the pressure on companies to improve their sustainability. For example, the EU Corporate Sustainability Reporting Directive will take effect from January 2023,2 expanding both the number of companies required to report their emissions and the scope of that reporting. Mandated reporting will now include Scope 3 greenhouse gas emissions (Figure 1), as well as requiring reports to be assured by third parties, as well as to be computer readable. These laws will apply to large or listed companies within the EU, including non-EU companies with significant activity inside the bloc. Taken together, these new requirements will significantly alter the landscape of climate-related reporting. It will be significantly easier to investigate the environmental impact of a company and to hold them to account.

Figure 1: An illustration of Scope 1, 2 and 3 emissions in a value chain, with definitions of the different scopes.3

Globally, the healthcare industry accounts for approximately 5% of emissions.3 However, unlike other, less necessary, sources of emissions, such as air travel for leisure, it is not possible to reduce emissions from the healthcare industry by simply reducing the amount of activity. This article will discuss the findings of an investigative assessment of healthcare products’ environmental impact. Especially in patient-led care, the investigation found that, despite having seemingly large environmental impacts, good early interventions, such as pressurised metered dose inhalers (pMDIs), in fact avoid greater environmental damage by preventing more serious interventions later on.4 As such, a more nuanced solution is required to reduce emissions in the industry.

“Several methods are being used to try and reduce emissions – such as designing new products, improvements to the manufacturing process and the Energize initiative to enable suppliers to buy renewable energy collectively.”

PUBLIC COMMITMENTS

Of the 10 largest pharmaceutical companies by sales, all have committed to reducing their environmental impact. Some began reducing emissions as early as 2000, but some have only begun making serious, quantified commitments since 2019. Predominantly, these commitments focus on CO2 equivalent (CO2e) emissions, plastic waste or water use within the operations of the company – that is, Scope 1 or 2 CO2e emissions and plastic waste or water use within the direct control of the company.

Some of these targets are highly ambitious, such as Novartis’ target to be carbon neutral across their entire value chain by 2030,5 or AstraZeneca’s “Ambition Zero Carbon” to be carbon negative across their entire value chain by 2030.6 Some are less ambitious, with later deadlines and smaller reductions.

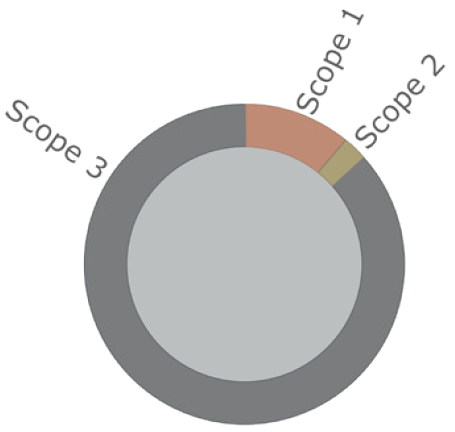

Figure 2: An illustrative graphic of the typical proportions

of Scope 1, 2 and 3 emissions among the top 10 pharmaceutical companies.

Only seven of these emissions-based commitments were accredited by the Science Based Targets initiative (SBTi).7 The SBTi encourages companies to set science-based net-zero targets and assesses whether targets are in line with a 1.5°C future. Across the industry, the general trend is to make large commitments on the easy wins, focusing on a company’s own operations, with more limited commitments in more difficult areas, such as Scope 3 emissions or water use.

Scope 3 emissions, however, made up approximately 80% of the reported emissions from these companies. Figure 2 illustrates some typical proportions of Scope 1, 2 and 3 emissions. Scope 3 emissions are still a consequence of a company’s actions and, to a great extent, can be changed by decisions taken by that company. Given that Scope 3 emissions constitute the majority of the total emissions involved, meaningful targets must involve reductions in Scope 3. The largest quantified Scope 3 reduction target the assessment found was 50%, whereas a typical target was only 20%.

Changes are being considered or implemented from the level of individual devices and manufacturing sites, all the way up to business-wide strategies. Several methods are being used to try and reduce emissions – such as designing new products,8 improvements to the manufacturing process9 and the Energize initiative10 to enable suppliers to buy renewable energy collectively. Some companies have also installed renewable energy generation directly on their own sites.

For example, GSK is altering some of its synthesis pathways to use enzymes, delivering massive efficiency savings. Johnson & Johnson has changed some of its packaging, using materials and methods that are novel to the pharmaceutical industry, meaning that the change required serious investigative work to meet regulations. Both of these measures are good examples of the scale of change required – on average, these 10 companies still need to reduce even their Scope 1 and 2 emissions by half. In a highly regulated industry such as pharmaceuticals and healthcare, these changes take time and must therefore be started now.

PROGRESS – TOO LITTLE, TOO LATE?

Are these efforts succeeding? Across other industries, the outlook is poor – large companies are failing to meet their emissions targets by as much as 60%, and a report from the New Climate Institute found that none of the 25 large companies they investigated in 2021 were achieving a high standard of improvement.11

Among pharmaceutical companies specifically, progress so far has been mixed. A few companies set climate-related targets as early as 2010 or 2000. GSK, for example, set a target of reducing water use by 20% between 2010 and 2020, and reported a successful reduction of 30% in 2020.12 Similarly, Merck aimed to reduce greenhouse gas emissions by 10% between 2010 and 2015, and managed a 13% reduction.13

However, other targets were not met – seven out of the 10 largest pharmaceutical companies either failed to meet, or failed to report, the outcome of at least one of their targets. Some only fell a little short; for example, a target to reduce waste to landfill by 100% only reduced waste by 85%. Others failed badly, such as one company that published a target to reduce water discharge by 4% over two years, but actually increased water discharge by 15%.

“Some companies seem to be struggling with the sheer scale of this task; for some of the companies in the assessment, emissions increased from 2020 to 2021.”

Several companies have openly stated that they will use carbon offsetting or compensation, despite the well-documented issues around these practices. Firstly, it is clear that there is already an urgent need to decarbonise global economies and further reduce the amount of carbon dioxide already in the atmosphere by capturing carbon.14 The second issue is that carbon offsetting methods are widely unaccountable, with flaws including:

- A lack of additionality, where credits are issued for carbon offsetting that would have occurred anyway

- Carbon “leakage”, where credits are issued for halting an activity that actually continues in a different location.15

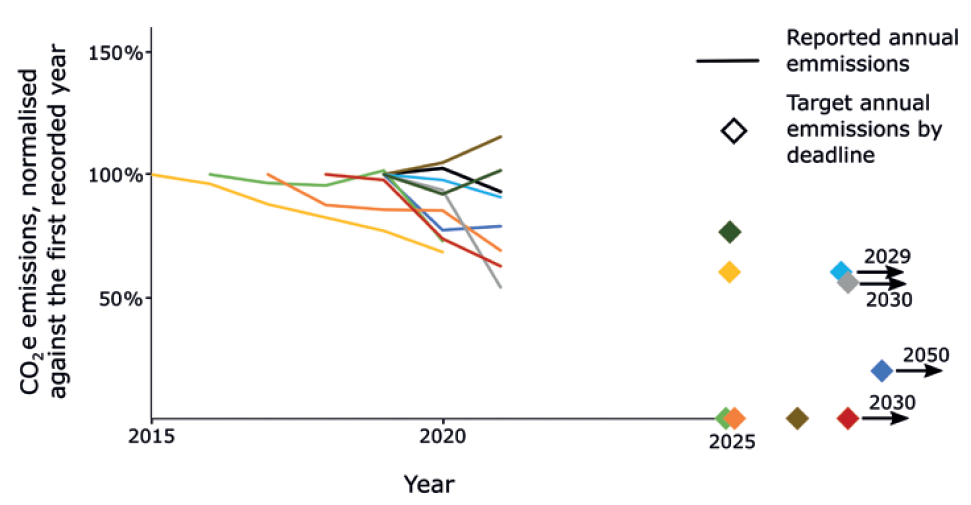

The work that remains is daunting, but necessary. The typical reduction over the last two reported years was 7% for Scope 1 and 2 emissions, and 6% for Scope 3 emissions. Five of the 10 largest pharmaceutical companies increased their emissions over the last two reported years. Figure 3 shows the reported Scope 1 and 2 emissions, where available, since 2015, normalised against the first reported year, as well as the targets that these companies are aiming for. Among the companies investigated in the assessment, the average reduction in Scope 1 and 2 emissions they needed to make annually to reach their target was 15%. Now, some must make reductions as large as 25%.

Figure 3: A graph showing the reported Scope 1 and 2 emissions from the top ten pharmaceutical companies, where available. The emissions are normalised against the first reported year’s emissions. The diamonds indicate the target annual emissions these companies have committed to reaching.

“Companies will need to develop industry-specific strategies around supplier selection and management, and to design products with the logistical and manufacturing implications in mind.”

Some companies seem to be struggling with the sheer scale of this task; for some of the companies in the assessment, emissions increased from 2020 to 2021. One was able to report a 53% reduction in water usage at one manufacturing site, but this took over a decade. Another company was able to report a 3% reduction in energy consumption, but only because natural disasters had closed multiple production sites.14 Many companies are still assessing the true size of their environmental footprint, carrying out internal investigations and beginning conversations with suppliers. This is only the first step in reducing emissions and, as self-imposed and external deadlines move ever closer, the time available to make these changes is slipping away.

Of all the pre-COP26 targets the assessment was able to find for the top 10 pharmaceutical companies, only half were achieved.

WHAT TO DO NEXT?

Some avenues companies could explore include lifecycle assessments of existing business strategies and devices; root cause analyses of inefficiencies, pinpointing the main problems with a device or logistical set up; moving on to concept generation and feasibility assessments (including sustainability) for the solution; and potentially, where the necessary changes are significant, re-evaluating the entire product development process, from blue sky concept generation to manufacture, verification and validation. Given that climate change has been on the agenda for over a decade now, most of the low-hanging fruit may already be gone.

In the authors’ experience, it is critically important to have both breadth and depth of skills to tackle these problems. The authors have found that engineering and scientific expertise, alongside a strong understanding of the business objectives, regulatory requirements and, vitally, industry experience are all needed to assess such problems clearly and then to find workable solutions and implement them successfully.

Companies will need to develop industry-specific strategies around supplier selection and management, and to design products with the logistical and manufacturing implications in mind. Cold chain transportation, for example, is energy intensive, but could be minimised with thoughtful drug formulation and good device design. Similar savings could be made in a variety of device types if world-class expertise and insight are applied to the project during the early design stages.

The targets set at and around COP26 were a good and necessary start. Moving further into the 2020s, however, it is clear that a serious effort from all parts of the pharmaceutical industry is required if these goals are going to be met and further climate harm minimised. Following the implementation of the EU Corporate Sustainability Reporting Directive, many companies will be forced to quantify and report their emissions to stakeholders, such as their shareholders, governments and, of course, themselves.

If you recognise any of these issues and would like to discuss how Springboard can assist your organisation, please contact Catriona Eldridge.

REFERENCES

- “COP26 Health Programme”. World Health Organization webpage, accessed Sep 2022.

- Kreusch L, “The Corporate Sustainability Reporting Directive (CSRD)”. Plan A, Jun 2022.

- Watts N et al, “The 2019 Report of The Lancet Countdown on Health and Climate Change: Ensuring that the Health of a Child Born Today is not Defined by a Changing Climate”. The Lancet, 2019, Vol 394(10211), pp 1836–1878.

- Udale R, Eldridge C, Shah O, “Are Governments Banning the Most Environmentally Friendly Inhaler?” ONdrugDelivery, Issue 132 (Apr-May 2022), pp 30–35.

- “Targets”. Novartis webpage, accessed Sep 2022.

- “AstraZeneca’s ‘Ambition Zero Carbon’ Strategy to Eliminate Emissions by 2025 and be Carbon Negative Across the Entire Value Chain by 2030”. AstraZeneca press release, Jan 2020.

- “Companies Taking Action”. Science Based Targets webpage, accessed Sep 2022.

- “AstraZeneca Progresses Ambition Zero Carbon Programme with Honeywell Partnership to Develop Next-Generation Respiratory Inhalers”. AstraZeneca press release, Feb 2022.

- “Environmental sustainability – Healthy Planet, Healthy People”. GSK webpage, accessed Sep 2022.

- “Energize”. NEO Network webpage, accessed Sep 2022.

- Harvey F, “World’s Biggest Firms Failing Over Net-Zero Claims, Research Suggests”. The Guardian, Feb 2022.

- “ESG Performance Summary 2020”. GSK report, Mar 2021.

- “Environmental, Social & Governance (ESG) Progress Report 2020/2022”. Merck report, Dec 2020.

- Hilaire J et al, “Negative Emissions and International Climate Goals–Learning From and About Mitigation Scenarios”. Climatic Change, 2019, Vol 157, pp 189–219.

- Harvey F, “What is Carbon Offsetting and How Does it Work?”. The Guardian, May 2021.