To Issue 156

Citation: Thompson I, “How Diabesity is Shaping the World of Self-Injection Devices”. ONdrugDelivery, Issue 156 (Jan 2024), pp 8–11.

Ian Thompson takes us through the recent history of diabetes and obesity therapeutics, the innovative peptide hormone molecules that have reached the market over the past decades and the equally innovative devices developed to deliver them. He addresses the growing challenge of diabesity, and shows that diabetes and obesity will continue to influence self-injection device development substantially.

THE EMERGENCE OF “DIABESITY”

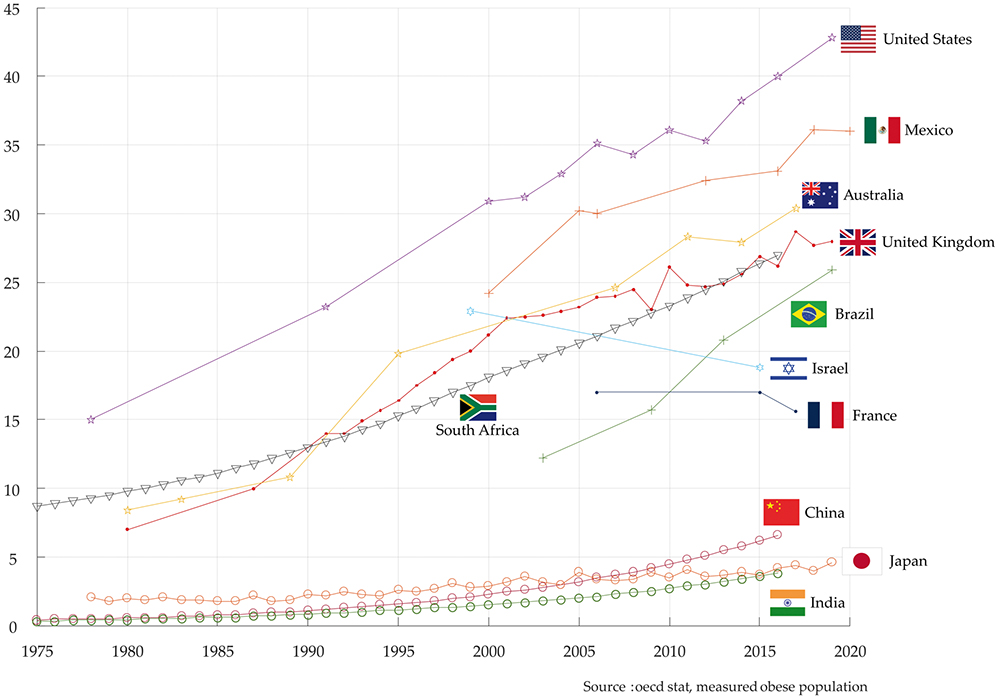

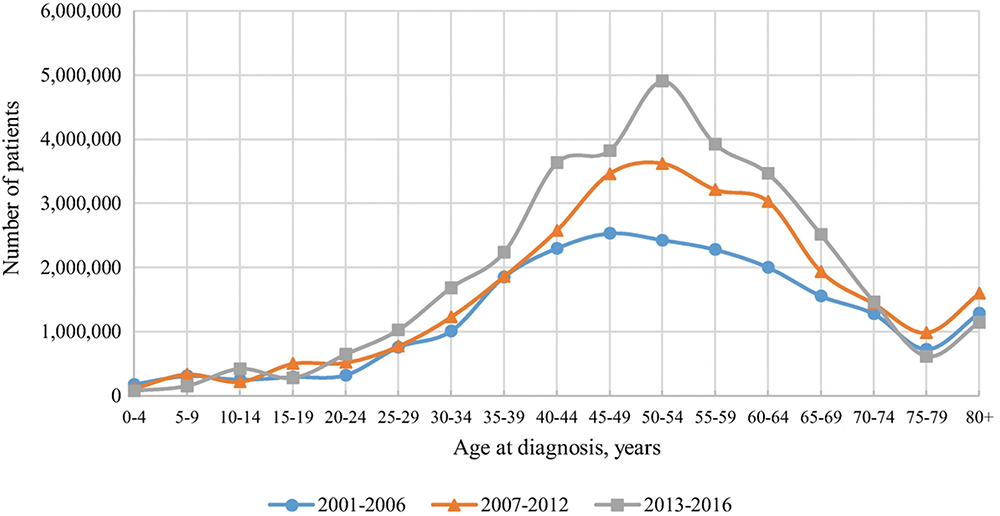

For people of all ages, the risk of Type 2 diabetes rises with increasing body weight and, in rich and developing countries, the prevalence of both obesity and Type 2 diabetes has increased continuously since the 1980s. No more so than in the US, where 35% of the population is obese, while rates in Europe range between 10–25% depending on the country (Figure 1). Today, the number of people with Type 2 diabetes is ~500 million globally, and approximately one billion people are obese. While around 50 million people, or 10%, of Type 2 diabetics are insulin dependent and peak diagnosis of Type 2 diabetes is established at around 50 years of age (Figure 2), there is a 15–30% overlap between the Type 2 diabetes and obesity populations, depending on the country. This means that there are many obese people who will potentially develop insulin dependency as they grow older.

Figure 1: Obese population (BMI >30) in selected OECD countries (% of total population).

Figure 2: Number of US adults with diabetes by age of diagnosis.3

Considering these numbers, there is a huge opportunity to treat obesity and thereby significantly reduce further growth in the number of people developing Type 2 diabetes, as well as other life-threatening conditions. Obesity is now recognised as a disease that increases the likelihood of comorbidities such as heart disease, hyperlipidaemia, hypertension, dementia, cancer and liver disease, as well as Type 2 diabetes. The overall costs to healthcare systems of treating these conditions is significant and there is a huge potential to reduce healthcare costs by reducing overall levels of obesity and Type 2 diabetes. The term diabesity is used to describe the combined adverse health effects of obesity and Type 2 diabetes / diabetes mellitus, and was coined in 1970s by Sims et al1 to describe the very strong pathophysiological link between diabetes and excess body weight. Visceral adiposity, which leads to insulin resistance, is the putative mechanism in the development of diabesity, leading to insulin dependent Type 2 diabetes.2

“The GLP-1 journey did not stop at treating Type 2 diabetes alone but has moved on to treating obesity, typically using higher dosing.”

THE RISE OF GLP-1 AGONISTS (INCRETIN MIMETICS)

Along with newer classes of oral drugs for treating Type 2 diabetes such as DPP-IV (dipeptidyl peptidase-4) inhibitors and SGLT-2 (sodium-glucose co-transporter-2) inhibitors, the GLP-1 (glucagon-like peptide-1) receptor agonist drug class is being prescribed to combat Type 2 diabetes and to slow patient progression towards insulin dependency.

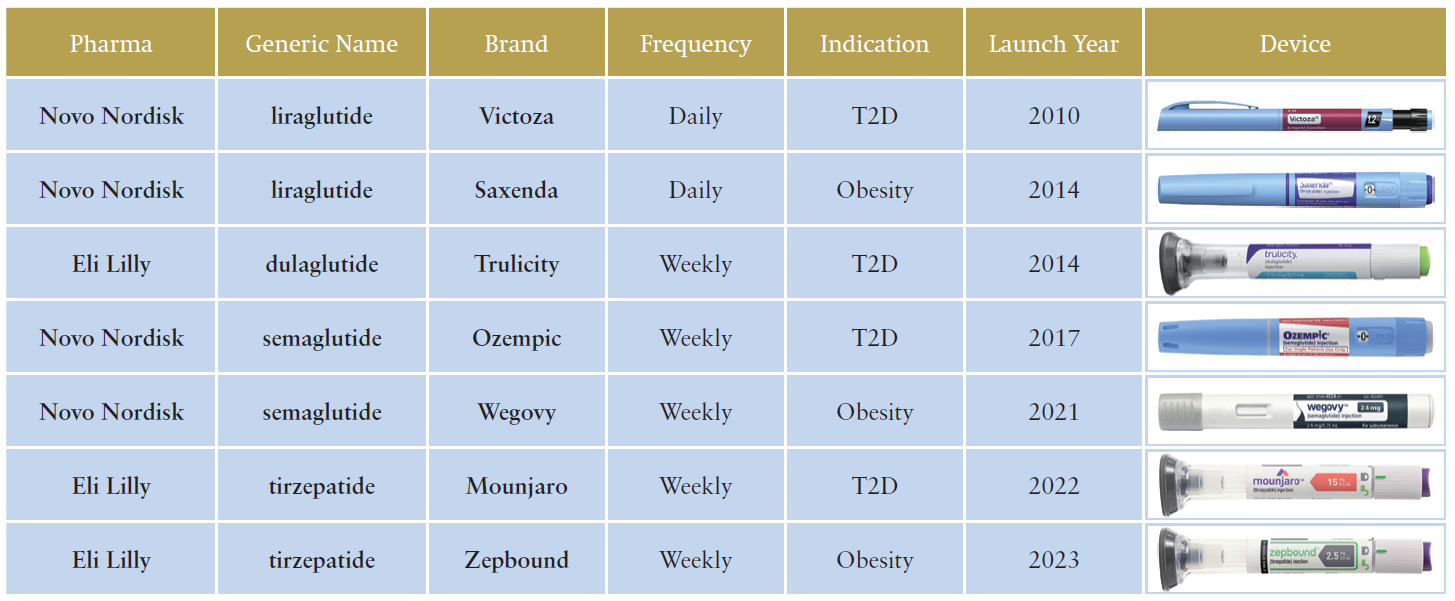

The commercialisation of GLP-1 receptor agonists (“GLP-1s”), also known as incretin mimetics, that enhance the response of the GLP-1 receptor, began nearly 20 years ago in 2005, with the launch of twice-daily injections of AstraZeneca’s Byetta (exenatide), followed by daily injections in 2010, with the launch of liraglutide (Victoza) from Novo Nordisk. The weekly formulations were launched around 10 years ago, but it was the launches of liquid-stable weekly formulations, such as Eli Lilly’s Trulicity (dulaglutide) in 2014, Novo Nordisk’s Ozempic (semaglutide) in 2017, and Mounjaro (tirzepatide), again from Lilly, in 2022, that is transforming the treatment of Type 2 diabetes today.

The GLP-1 journey did not stop at treating Type 2 diabetes alone but has moved on to treating obesity, typically using higher dosing. Following the approval of daily injected liraglutide by Novo Nordisk in 2014, branded as Saxenda for treating obesity in selected patient populations, the two leading GLP-1s semaglutide, launched as Wegovy for obesity in 2021, and tirzepatide as Zepbound in obesity in 2023, are now set to transform the treatment of obesity. Table 1 (next page) summarises the major product launches from 2010 to 2023.

Table 1: Launches of key GLP-1 related injectables by year (2010-2023).

“Peptide hormone targets that are in development as part of dual and triple agonist molecules include glucagon, amylin or islet amyloid polypeptide (IAPP) and calcitonin.”

Today there are around 15 million Type 2 diabetics and obese patients already being treated with GLP-1s and this is likely to increase to more than 60 million patients within 10 years. This number is therefore greater than the current patient population of around 50 million insulin-dependent Type 2 diabetes.

IMPACT ON SELF-INJECTION DEVICE DESIGN

The development of pens for self-injection, which are essentially “cartridge-based” variable dosing, multi-dosing syringes, coincided with the development of peptide hormones and their frequent daily injections, namely insulin, human growth hormone (hGH), follicle-stimulating hormone (FSH) and parathyroid hormone (PTH), and their use for the administering GLP-1s followed.

Reusable pens, introduced in the 1980s, evolved to more convenient prefilled pens in the 2000s and most pen demand today serves the diabetes market: insulin for Type 1 and Type 2 diabetes as well as the growing demand for GLP-1-based injectable drugs. Today more than 12 million reusable pens and more than 1.7 billion prefilled pens are sold annually, with the majority still sold to deliver insulin. GLP-1s are now responsible for the additional growth in demand for pens.

Peptide hormones have a low molecular weight, just 3–30 kDa, and are generally preserved formulations for use in multidose pens. Based on daily injections, the shelf-life of most peptide hormones like insulin and hGH is up to 28 days. With the development of long-acting peptide hormones like GLP-1 and hGH, soon to be joined by long-acting insulin, which are injected on a weekly basis, the shelf-life has been extended to up to 56 days. The fact that some GLP-1 receptor agonists like semaglutide can be formulated in a preserved way means that pens are an option for GLP-1s.

TWO-STEP AUTOINJECTORS: ANTIBODY THERAPIES & GLP-1s

Autoinjectors, as their name implies, automatically insert the needle, and perform the injection. They are typically spring driven and usually designed for use with staked-needle prefilled syringes. Ideally the drug is liquid-stable, and the full dose is injected.

Autoinjectors were introduced in the 1970s for military and emergency use, and reusable autoinjectors were introduced for frequently injected peptide-based interferons for treating MS (multiple sclerosis) in the 1990s.

In 2006 weekly and biweekly antibody-based therapies, such as the TNF (tumour necrosis factor)-inhibitors Humira (adalimumab from Abbott, now AbbVie) and Enbrel (etanercept from Amgen and Pfizer), were introduced for the treatment of rheumatoid arthritis. It was with these launches that the market for prefilled autoinjectors was born.

Today’s two-step manual-needle-insertion autoinjectors were subsequently launched 10 years later in 2016. They are buttonless, smaller and less complex than first-generation autoinjector devices. Today there are over 70 different drugs available in prefilled autoinjectors on the market totalling >450 million units annually.

Over the last seven years, more than 30 new devices have been launched and almost all are two-step push-on-skin devices.

The largest proportion of the marketed autoinjectors are already being sold for a handful of GLP-1 therapies dominated and controlled by the two market leaders, Novo Nordisk and Eli Lilly. Eli Lilly is the largest supplier of autoinjectors today, for Trulicity. With annual sales of US$7 billion (£5.5 billion), Trulicity is supplied exclusively in Lilly’s three-step autoinjector presentation.

EASY-TO-USE PENS & AUTOINJECTORS: SIGNIFICANT DEMAND

As previously discussed, some of the new GLP-1 injected drugs like semaglutide, which are simple peptides, can be formulated to be administered from a pen or from an autoinjector, while others like dulaglutide, which consists of GLP-1 covalently linked to the Fc region (fragment crystallizable region) of human IgG4 (immunoglobulin G4), are not available in a preserved formulation suitable for a pen. It is worth noting that monoclonal antibody (mAb) therapies as typically used for the treatment of autoimmune diseases can only be formulated for single-use for delivery from an autoinjector.

The future growth of the pen and autoinjector market is largely dependent on the relative success of current- and next-generation GLP-1 drugs. Even though autoinjectors are more convenient for weekly injections, far fewer pen injectors are needed annually per patient. For example, based on a pen containing four once-weekly injections, a patient would only require 13 pens annually compared to 52 autoinjectors. For every 10 million patients this equates to 130 million pens compared with 520 million autoinjectors annually!

CONTINUED DEVELOPMENT OF INCRETINS AND OTHER PEPTIDE HORMONES: DUAL AND TRIPLE AGONISTS

The dynamic market for GLP-1s for Type 2 diabetes and obesity is growing exponentially and will be even more exciting in future as there are ever more molecules in development from a broad range of pharma companies.

Explaining one of the key ways in which this market will develop first requires some more detail about the incretins group of metabolic hormones, which stimulate a decrease in blood glucose levels. Incretins are released after eating and augment the secretion of insulin released from pancreatic beta cells of the islets of Langerhans by a blood-glucose-dependent mechanism.

The main incretins are GLP-1 and gastric inhibitory polypeptide (GIP). Whereas the first incretin agonists targeted just GLP-1, both GLP-1 and GIP are the active targets of some of the new dual agonists such as tirzepatide. Other peptide hormone targets that are in development as part of dual and triple agonist molecules include glucagon, amylin or islet amyloid polypeptide (IAPP) and calcitonin.

Figure 3: Ypsomed’s key platform products for delivery of GLP-1 based therapeutics: UnoPen and YpsoMate.

Novo Nordisk and Eli Lilly, clearly have a dominant position and economy of scale for drugs to treat Type 2 diabetes and obesity, and both companies have new dual and triple incretin agonists in their pipelines. Other companies have dual and triple incretin agonists in their pipelines and are looking to enter the market.

Daily oral drugs will enter the market to join Novo Nordisk’s oral semaglutide, Rybelsus, in a few years’ time, including a new group of oral GLP-1s that includes Pfizer’s danuglipron and Eli Lilly’s orforglipron (collectively known and the “gliprons”), with approvals likely from 2027. The new glipron class is a non-peptide GLP-1 receptor agonist which is easier to manufacture than GLP-1s currently on the market, and is expected to be cheaper. How these oral products will impact the use of injectables is unclear.

“Ypsomed’s comprehensive pen and autoinjector platform portfolio, including UnoPen and YpsoMate, is ideally positioned to support the burgeoning demand for peptide hormones for treating Type 2 diabetes and obesity.”

YPSOMED PERFECTLY POSITIONED: BROADEST SELF-INJECTION PLATFORM PORTFOLIO

Ypsomed’s comprehensive pen and autoinjector platform portfolio, including UnoPen and YpsoMate (Figure 3), is ideally positioned to support the burgeoning demand for peptide hormones for treating Type 2 diabetes and obesity.

Ypsomed is building its global manufacturing footprint in Switzerland, Germany and China and manufacturing options in US are currently being assessed. In addition, Ypsomed has ongoing development projects with a range of companies active in the peptide hormone space and is developing next generation devices to better serve the needs of Type 2 diabetes and obesity patients.

REFERENCES

- Sims E et al, “Endocrine and metabolic effects of experimental obesity in man”. Recent Prog Horm Res, 1973, Vol 29, pp 457–496.

- Michaelidou M, Pappachan J, Jeeyavudeen M, “Management of diabesity: Current concepts”. World J Diabetes, 2023 Vol 14(4) (April), pp 396–411.

- Phuc L et al, “Trends in Age at Diagnosis of Type 2 Diabetes Among US Adults from 2001 to 2016”. J General Internal Med, 2021, Vol 36, pp 1144–1146.