To Issue 134

Citation: Monroe N, “Connectivity in Healthcare – from the Millennium to the Pandemic and Beyond”. ONdrugDelivery, Issue 134 (Jun 2022), pp 8–12.

Napoleon Monroe looks back at the factors that influenced the underwhelming uptake of connectivity-enabling technologies in the healthcare sector over the first two decades of the 21st century, how the covid-19 pandemic changed everything and what current healthcare challenges connectivity might solve.

“A number of factors significantly limited the adoption of telemedicine and post-market surveillance.”

FROM 2000 TO 2019

As we entered the new millennium, connectivity enabling technologies were readily available and had matured to the point where they could provide real value to the field of telemedicine. However, a number of factors, including the traditional in-person fee-for-service payment model, inertia, success measured by product sales rather than patient outcomes, state licensure requirements, litigation and legacy expectations significantly limited the adoption of telemedicine and post-market surveillance.

However, in recent years, specialty pharma and other biotech products came to dominate pharma sales volumes, profitability and new product filings. This led to at-home administration becoming a more important factor in the healthcare ecosphere. As a result, digital therapeutics supporting at-home drug administration became increasingly available.

During this period, pharma companies and many contract development and manufacturing organisations (CDMOs) concentrated primarily on producing drugs, with some placing a secondary focus on mechanical drug delivery devices, although some also put work into connected devices (Box 1). Several companies attempted to establish patent protection on their connected products. However, most of Pharma’s patent efforts remained on drug formulations, carriers or mechanical devices. Meanwhile, non-practising entities accumulated patents related to connected drug delivery, and a few pharma companies introduced connected drug delivery products.

BOX 1: GLOSSARY OF TERMS

Connected Devices – Devices that incorporate means claimed in the mMed portfolio to communicate for purposes such as data sharing to provide patients, healthcare practitioners, caregivers and many others with near real-time or stored and forwarded information. These devices also are “smart”, in that they incorporate means that allow for analysing data to enable assisted intelligence and machine learning. Connected drug delivery devices are important to remote administration of specialty, personalised and targeted drugs.

covid-19 – All variants of the covid-19 pandemic.

Drugs – Small-molecule chemicals or large-molecule products, including biologics and cell, gene and other DNA-based therapeutics.

Medication Compliance – The act of taking medication on schedule or taking medication as prescribed.

Medication Adherence – The act of filling new prescriptions or refilling existing prescriptions on time.

Pharma – The pharmaceutical industry.

pharma – Abbreviation of “pharmaceutical”.

“Meanwhile, non-practising entities accumulated patents related to connected drug delivery, and a few pharma companies introduced connected drug delivery products.”

The US has strong, enforceable intellectual property regulations, with patents being key to the growth of US Pharma and other US industries (Box 2). US leadership in producing new medicines was at this point already well established, and Pharma’s product patent coverage was essential to avoid competition for breakthrough production. The US was leading or developing leadership in consumer healthcare-related products and services, such as wearable health devices (Apple), online research (Google), office software (Microsoft) and e-commerce (Amazon, which began offering its web-based infrastructure to businesses in 2006).

BOX 2: PATENTS AS PART OF THE CHANGE IN CONNECTED HEALTHCARE

New Directions’ research shows that many organisations, including non-practising patent aggregators, have anticipated the introduction of connected medication management by filing and/or licensing patents, investing, merging, securing regulatory approvals, promoting and using connected medication management products to further their financial objectives and improve patient outcomes.

Forward patent citations are a well-known measure of patent value. In 2021–2022, New Directions funded research showing that there have been more than 500 first-generation forward citations of New Directions’ US patents (Figure 1), more than 6,400 subsequent generation citations and a substantial number of 102/103 US Patent Office actions. Research provided evidence of use by multinational pharma and drug delivery companies. Analyses of forward citations have been prepared for some companies. Based primarily on continuing forward patent citations and the intense commercial activity in connected drug delivery, as estimated by a leading patent research company, patent valuations have continued to increase over the 2020s.

New Directions entered the medication management field with patent filings early in the era of connected medication delivery product development. New Directions was able to secure claims that are of significant value to companies engaged in activities related to connected drug delivery.

Figure 1: The mMed portfolio comprises five granted US patents, as well as the counterpart Israeli and Australian patents, on products invented by Napoleon Monroe and assigned to New Directions Technology Consulting, LLC, as shown on New Directions’ website.

At this point in time, electronic medical records (EMRs) were a requirement in the US, but were primarily for billing purposes and were not interoperable. Automated identity and data capture (AIDC) was discussed but was only mandated by legislation for high-risk pharma and device manufacturers and distributors in 2013. Also around this time, US Pharma developed a reliance on direct-to-consumer “Ask your doctor” style advertising after regulators closed other marketing channels.

Low borrowing costs and the prospect of broadened anti-trust regulation drove mergers and acquisitions. Many pharma, device and healthcare companies were rolled up, reducing the number of big healthcare players while, simultaneously, US tax policy provided benefits to big corporations. Outsourcing and offshoring became rampant. When Pharma exited some foreign operations, lower quality producers often took over. In general, this timeframe saw drug prices and healthcare costs increase rapidly. Meanwhile, the gig economy and movement away from expensive corporate employee and retiree insurance significantly reduced the number of individuals in the US who had good healthcare insurance. Indeed, the number of underinsured and uninsured people grew significantly.

“Emergency-use approvals were granted for telemedicine and pharma compounds to help stop the spread of the virus, and insurers began paying for telemedicine.”

THE PANDEMIC AND BEYOND

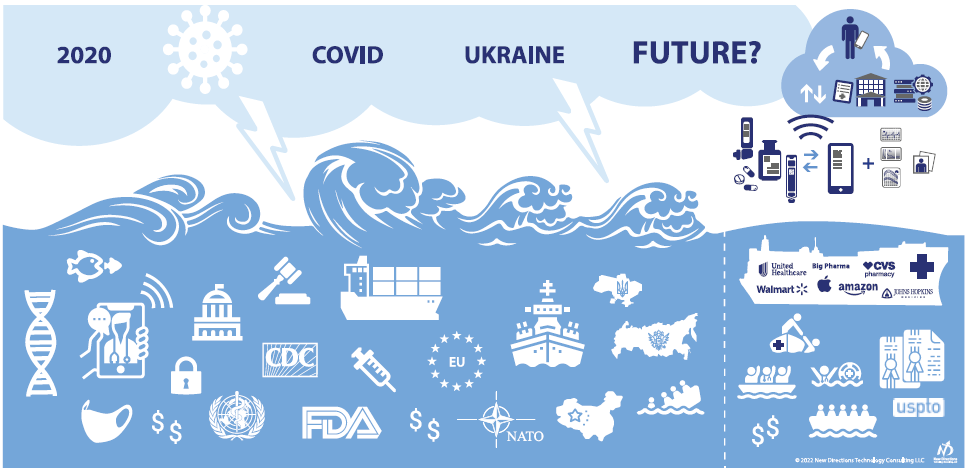

Although the epidemiologic threat of a pandemic had been discussed, governments largely failed to make preparations for such. A contributing factor, especially in the US, was the increasingly fractious nature of the political landscape. Therefore, when covid-19 struck, sweeping, and often draconian, emergency measures were required to combat the ensuing pandemic. It is these restrictions that finally drove acceptance and adoption of telemedicine into the mainstream (Figure 2).

Figure 2: The covid-19 pandemic has been a key driver of connectivity and telehealth’s acceptance in mainstream healthcare. However, now that it is here, it is time to realise the full potential that it offers.

Emergency-use approvals were granted for telemedicine and pharma compounds to help stop the spread of the virus, and insurers began paying for telemedicine. Concerns about medications and healthcare were generally heightened worldwide. In the US, the government funded emergency Pharma responses to covid-19, as well as stimulus payments to businesses and individuals. Pharma responded to covid-19 by shifting strategies, intensively researching and successfully producing vaccines and antiviral treatments. Research accelerated across the spectrum of biotech healthcare product classes, leading biotech to advance rapidly, even beyond covid-19-related treatments.

However, covid-19 also resulted in labour shortages, demand volatility, uncertainty and logistics failures that demonstrated supply-chain weaknesses affecting everything from plastic resin supply to patient treatment. Counterfeit, adulterated, misbranded, off-label and diverted products became widespread, while waste, fraud and other abuses also flourished. Price gouging was frequent. Automation resourcing and telemedicine were adopted in crisis mode to help ease the effects of supply chain dislocations. Pharma’s wealth grew from research, production and sale of vaccines and treatments.

Pharma, insurers, providers and others made big-data storage and analytics investments. Complex, ever-changing covid-19 news, including of actual and potential mutations and variants, caused confusion and science denial, leading to widespread misinformation, disinformation, conspiracy theories and public malaise. The virus highlighted disparities in the healthcare system, as well as the societal costs of inaction. Medical treatment institutions were stressed and understaffed. Necessary chronic – even emergent – disease treatments and other procedures were postponed.

Companies that were not part of the traditional healthcare system, such as CVS, Walmart and Amazon, provided covid-19 vaccinations and became more deeply involved in healthcare. They and traditional healthcare companies contracted and merged with or acquired providers and other stakeholder companies – partly due to the fact that, while inflation accelerated, borrowing costs remained low in the early phases of the covid-19 pandemic.

“This data gathering potential also presents the opportunity for stakeholders to pay for only the products and treatments that provide the most significant improvement to health outcomes.”

ACCELERATING BREAKTHROUGH PRODUCTS

There has been an emphasis on accelerating approval for marketing of generic, biosimilar and breakthrough products.

The US FDA issued new guidance for sponsors to make the development of generic versions of complex products more efficient. It prioritised review of many complex generic drug applications and developed a path for approving generic versions of complex combination products that did not require the generic to be an exact copy of the innovator delivery system. Teva’s EpiPen (adrenaline, Teva Pharmaceuticals, Tel Aviv-Yafo, Israel) was the first approval under this programme. This was part of an effort to prioritise the approval of medicines with little or no generic competition, within an overarching goal of removing barriers to generic development and market entry for critically important medicines at lower prices.

The FDA has moved to rely more on standards, such as ISO 13485, that emphasise design control, defect analysis, adverse reaction reporting and post-market surveillance. Complex drug delivery systems have been known to struggle with component changes, responses to which include the Drug Supply Chain Security Act (DSCCA) and the implementation of unique device identifier (UDI) AIDC systems, both having serialisation requirements for prescription pharma and critical medical devices. The DSCSA and UDI implementation schedules are currently being finalised after much delay.

The FDA is ahead on the regulation of connected devices and software as a medical device, essential for automated and assisted intelligence. Both US and EU device regulators are now focused on patient outcomes, a principle often referred to as “patient-centricity”. The EU Medical Device Regulation (MDR 2017/745) requires post-market clinical follow-up. Both the EU and US are making moves to bring clinical outcomes under the purview of their regulatory agencies to ensure the safety and efficacy of healthcare products.

A NEW CONNECTED REALITY ON THE HORIZON

Connected devices enable the gathering of real-world information on patient outcomes, presenting both devices and drugs with opportunities for ensuring efficacy beyond clinical trials. This data gathering potential also presents the opportunity for stakeholders to pay for only the products and treatments that provide the most significant improvement to health outcomes.

In recent presentations, an FDA executive used the term “market intelligence” in her title. Furthermore, FDA digital initiatives and the newfound FDA patient-centricity model make a compelling case that, while the FDA does not regulate dental or medical practice, change is on the horizon for the healthcare sector. Medication compliance issues and post-market efficacy questions are inspiring the industry to offer new connected drug delivery products.

There is also movement towards greater, or even universal, EMR interoperability. This has been required by legislation and incentivised by payers. A 2020 Office of the National Coordinator (ONC) ruling required that information be more standardised and imposed terminology standards on the structure and meaning of information in EMRs. The objective was, and is, making patient data more interoperable for patients, providers, payers and the greater healthcare ecosystem.

Prescriber EMR systems, such as those in the dental industry, which have traditionally not been interoperable, are becoming so with the adoption of Health Level 7 and Fast Healthcare Interoperability Resources. This is a further step towards meaningful use of patient records in the fuller sense. Additionally, stakeholders are increasingly adopting computerised provider order entry (CPOE), which is integral to medication and device management, for home-use and other prescription products. Some EMR products now come equipped with CPOE modules that enable electronic entry of patient medication data.

The FDA has advised that they are monitoring the post-market performance of medical devices and pharma products to a greater degree than before. They have also announced that the Safety Signals and the National Evaluation System for health Technology (NEST) programmes are being included in the Manufacturer and User facility Device Experience (MAUDE) database. While these two programmes were device specific, note that a programme in one FDA division often has an agency-wide impact overall.

AIDC and EMRs are facilitators for healthcare data collection. While AIDC is still not widely used by many practitioners, the newfound regulatory focus on post-market information is making AIDC more appealing and, in some cases, necessary. Regulators and payers are encouraging, or even requiring, the use of UDI in the transaction set defined by the American National Standards Institute X12 electronic data interchange (EDI) standard that prescribes the exchange of information between two businesses using electronic means. A type of EDI transaction set is the EDI 810, which covers how invoices are to be exchanged between trading “partners”, so any party wishing to get paid for their services will be required to conform to this standard.

Pharma and CDMOs have devised a strategy of adding connectivity to existing mechanical devices, such as inhalers and injection pens, using add-on devices. These connected platforms, including connected labels, could be approved as devices and added to multiple designs of drug delivery devices. With the expansion of broadband availability, particularly to underserved communities, this would be a boon to healthcare. Pharmacists are encouraging comprehensive medication management to improve information availability, medication adherence and compliance and limit adverse reactions.

OVERCOMING HEALTHCARE OBSTACLES THROUGH CONNECTIVITY

Price control legislation and policies regarding pharma products are advancing, with patient support groups and large associations, such as AARP (Washington DC, US), are pushing for price controls. Connectivity and connected devices can be a means to help demonstrate a pharma product’s value and resultant improved patient outcomes, as well as to gain brand loyalty.

“Connectivity and connected devices could play a key part in rebuilding trust for all healthcare stakeholders.”

The current emergency measures to extend telemedicine and accelerate new, generic and biosimilar drug approvals may expire. These expirations could cut both ways. Connectivity and connected devices can play a part in strategies to enhance corporate value to patients, whatever the political decisions on extensions may be.

The Centers for Medicare & Medicaid Services recently refused to pay for the Alzheimer’s disease treatment Aduhlem (aducanumab-avwa, Biogen, MA, US) unless patients were entered in a clinical trial. Furthermore, restrictions on pharmacy benefit managers and insurer formularies are expanding. Payment for outcomes rather than products is becoming more of a reality. AIDC (via serialised barcodes), connected devices and product support using telemedicine can help demonstrate outcomes and secure reimbursement.

The US is exceptionally litigious – settlements and incarcerations related to opioid marketing, price fixing and fraud have accelerated. Without knowledge of the entire supply chain, up to and including the patient and patient compliance, specious liability claims are harder to counter. As such, knowing the full supply chain is critical for avoiding specious liability claims.

US manufacturers and distributors are focused on strategic shifts in their mix of products and choice of foreign partners, with a focus on shortening supply chains, multisourcing and reshoring. Some pharma companies are in the process of divesting themselves of their foreign assets. Connectivity and AIDC can help discover and understand the changes occurring deep in supply chains as these changes take place. Additionally, cyberwarfare and unreliable suppliers are known to have disrupted some healthcare efforts and supply chains – connectivity and AIDC can help uncover both.

The covid-19 pandemic heightened the media’s focus on other current and potential US epidemics, such as mental health; medication over-prescribing; the opioid crisis; obesity; cancer; drug non-compliance, non-adherence resistance, and ineffectiveness; and un- and undertreated diseases. In all these cases, increased compliance, as can be achieved using connected devices, can help improve patient outcomes. Pharma, government, patient support groups and various other corporate entities are keen to improve healthcare messaging. Connectivity allows stakeholders to tailor communication to those individuals who most need it and who can best use the available information to improve health outcomes.

Inflation has accelerated dramatically worldwide, and the US Federal Reserve has indicated that more interest rate increases are likely – costs are increasing in every sector and Pharma is no exception. However, any added cost resulting from connectivity can be justified based on the benefits it provides for all stakeholders, and is less likely to be apparent when all costs are rising across the board. Additionally, it should be noted that the known unreliability of some foreign intellectual property systems presents a great cause for concern about enforceability of patents in some out-of-US jurisdictions. This lends even greater weight to US patents.

It is becoming increasingly evident that, currently, there is a significant level of corporate and personal insecurity across society, which has led to the realisation that change must come to US civil society – including the broken US healthcare system. Connectivity and connected devices could play a key part in rebuilding trust for all healthcare stakeholders.

CONCLUSION

All these events flowed and continue to flow into waves of efforts to promote improvements in US healthcare that will lead to better patient outcomes. Some elements will continue to influence the 2020s and beyond. Of course, change is not without its downsides; changes are sometimes badly designed and badly communicated. The influx of non-MD healthcare practitioners has led to errors, miscommunication, confusion and non-responsiveness. The pace of change has accelerated. The events and attitudinal changes we are currently witnessing are both disruptive and invigorating (Figure 3).

Figure 3: Navigating storms towards calmer seas and the rescue of patients from a battered and ailing healthcare system.

Ultimately, the coming changes will necessitate connectivity in healthcare, drug delivery and packaging, allowing for more timely corrective actions as they are needed. It is inevitable that, going forwards, well-managed connectivity and connected devices will improve healthcare.