Citation: “Pharmapack Europe Drug Delivery and Packaging Annual Survey 2021″. ONdrugDelivery, Issue 126 (Oct/Nov 2021), pp 18–24.

Pharmapack presents the results of its annual survey and market report, covering the latest Pharmapack Innovation Index and the inaugural Pharmapack Sustainability Index, and taking stock of where the survey results suggest the pharma industry currently is, and where it is heading, in terms of innovation and sustainability.

This article was originally published as part of a market survey report by Pharmapack Europe.

INTRODUCTION

Stimulated by the pandemic, innovation in the pharmaceutical industry has gone through a golden period of advancement and, as a result, the drug delivery and packaging markets have also seen a period of continual growth and innovation. Whether it be vials, autoinjectors, connected devices or the cold-chain storage of lifesaving covid-19 vaccines, the pharmaceutical packaging and delivery sectors have played a key role not just in fighting the pandemic but in more generally transforming the way we deliver and take medicines.

With a rise in the rate of chronic diseases and a significant number of vaccine doses being manufactured for covid-19, it is anticipated that there will be an increased demand for primary packaging, and for glass containers in particular. In fact, according to Allied Market Research, the glass segment is estimated to register the highest compound annual growth rate (CAGR), 8.5%, between 2020 and 2027.1

More broadly, there have been a raft of changes across the pharmaceutical drug device delivery and packaging sector in the past few years, with a continued drive by drug delivery device and packaging manufacturers towards patient-centricity. The aim being to improve the patient experience, and also to increase patient compliance and reduce attrition rates. Yet, with the proliferation of smart packaging and devices, these goals have often worked against the industry’s other main trend – improving sustainability. Answering the concerns around the rising amount of non-degradable plastic waste, drug delivery device and packaging companies have sought out greener, more sustainable solutions including the use of bioplastics and blister packaging.

This article will dive deeper into these juxtapositions, evaluate the changing perception of innovation in the drug delivery device sector, and explore how far along each country is in terms of optimising the sustainability of pharma devices and medicines. Looking further ahead, we will discuss insights into which areas of drug delivery device development will see the greatest innovation over the next five years, as well as postulate what will be the most used primary oral dosage packaging.

METHODOLOGY

The report’s key metric, the Pharmapack Innovation Index (Box 1), saw over 350 companies score the most innovative countries, with a further 50+ companies supporting a deep-dive analysis into the pharmaceutical drug delivery device and packaging sector as whole. Not only do the results provide key indicators of the overall strength of the industry but they also deliver insights into the areas that have seen the biggest year-on-year percentage rise. In total, executives from five continents – including all of the major pharmaceutical markets – provided responses, giving a diverse global perspective on the drug delivery and packaging market.

BOX 1: PHARMAPACK INDEX RESULTS AT A GLANCE

Pharmapack Innovation Index

India has seen the fastest (12%) rise in innovation while the US has extended its lead over Europe, where Germany has retaken the regional top spot from Switzerland.

Pharmapack Sustainability Index

Europe is leading on pharma packaging and device sustainability, well ahead of the US.

RESULTS

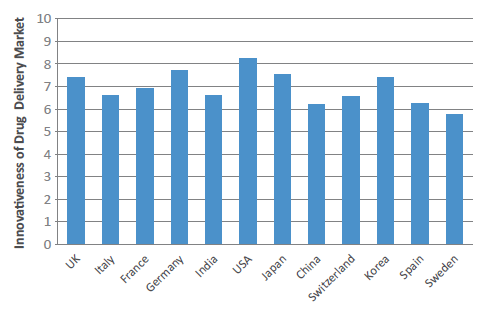

The report’s key metric, the “Drug Delivery Innovation Index” – scored out of ten (Figure 1) – is designed to assess the perceived strength of each market’s innovativeness, with the overall market perception rising by 1.81% year-on-year. This suggests, as many people would expect during the pandemic, that the last year has been a very productive time for the industry in terms of new ideas, delivery mechanisms and devices.

Figure 1: Drug Delivery Innovation Index 2021 (scores by country out of 10).

The US has remained unchanged at the head of the pack, maintaining its position as the world’s most innovative country in the drug delivery field, with a score of 8.26. The other tier one markets, Germany (7.69) and Japan (7.52) – 2020’s second and third placed economies – have both seen a slight year-on-year score increase. The UK (7.39) has moved narrowly ahead of last year’s pre-eminent European market, Switzerland (7.38) – which has, surprisingly, fallen back. In fact, the UK has seen a flurry of innovative drug delivery device announcements in the last 12 months, including the much publicised and discussed acquisition of UK asthma inhaler company, Vectura – which is reportedly set to be acquired by Philip Morris (NY, US) after a number of prominent offers, including one from the private equity house The Carlyle Group (WA, US).2

However, by far the biggest surge came from India (6.62) – a country that had already seen a massive 25% increase in 2020 – with a year-on-year increase of around 13%. Consequently, India has moved ahead of China (6.18), Spain (6.23), Korea (6.57) and Italy (6.58) to firmly consolidate itself in the third tier of the most innovative nations. While India’s rise will seem surprising to some, the country has shown significant interest in the drug delivery industry, and this is none more so reflected than by the world’s first DNA vaccine, ZyCoV-D (Cadila Healthcare, Gujarat, India). While the vaccine is itself a world first, the delivery mechanism is equally novel – subcutaneous administration using a needle-free device pressed against the skin.3 India’s ongoing rise could also signal wider changes ahead, as the emerging nations begin to compete on innovation as well as cost (Box 2).

BOX 2: EXPERT PERSPECTIVE ON INNOVATION IN CHINA AND INDIA

“There has indeed been a lot of activity and interest from Indian and Chinese organisations focused on developing lookalike models of existing European or US devices, including dry powder inhalers and soft mist inhalers. Such developments could well morph into completely new devices, although it is common to see new inhaler technologies developed for a specific formulation at the behest of a pharma company. Any trend in innovations will likely also be influenced by new formulations or APIs.

As for pen injectors or autoinjectors, there may be greater scope for a device suitable to a range of drug types or formulations that can be licensed to a pharma company, and hence there may be more scope for device innovation in these areas.”

– Andy Fry, Founder, Team Consulting

More broadly, the back-to-back double-digit improvements in its Drug Delivery Innovation Index score indicate positive sentiments towards the developments in manufacturing and biosimilars, as well as the rise of new biotech targets that are permeating through the market into drug delivery and devices innovation. Another major driver in India’s significant development within the space is the introduction of R&D initiatives such as “Start Up India’” and “Make In India”, with foreign direct investment and manufacturing sites increasing significantly during the pandemic.4

WHAT DOES THE OVERALL SCORE TELL US ABOUT THE DIRECTION THE INDUSTRY IS HEADING?

The reputations of most markets displayed a healthy increase, perhaps reflective of the new confidence and positivity around pharma post-pandemic, and the overall index has risen 6% since 2019, which bodes extremely well for the industry. The direct impact of the pandemic has had consequences for the supply chain, especially early on, but covid-19 has also generated a plethora of opportunities across the industry.

One particular beneficiary has been digital applications and connected devices, which have seen rapid growth over the course of the pandemic. To list just a few, many countries have launched track-and-trace schemes, vaccine passports, virtual appointments and rapidly scaled up self-administrated therapies, with even the apps themselves now receiving US FDA approval. Many experts have identified apps as a potential new paradigm for mental health treatments.5

In Europe, the size of the drug delivery device industry was circa US$340 million (£248 million) in 2021,6 and the market is expected to grow by a CAGR of 5.9% until 2026, reaching $452 million. This is driven by a multitude of factors, including the prevalence of chronic diseases, increasing therapeutic options and the growth in the biologics and biosimilars market (Box 3). In particular, as a consequence of rising numbers of cancer, diabetes and respiratory patients across Europe, there is now a huge number that will require regular use of drug delivery devices for diagnosis and treatment purposes.

BOX 3: EXPERT PERSPECTIVE ON BIOSIMILARS IN EUROPE

“There are more biosimilar products in Europe than in any other market. Here you have a much stronger instinct across the health sector to adopt biosimilars to reduce the costs of treatment. However, what we are also seeing is that the numbers of biologics that are offered with devices is increasing. This is something that we have to expect and it is a positive development for injectable devices.”

– Dr Charbel Tengroth, Managing Director, Tengroth Consulting

Another trend that is accelerating post-pandemic is the trend towards self-administration. One only needs to look at the effects of overburdened hospitals during the pandemic to see the benefits this could bring in both the long and short terms. It is perhaps unsurprising that – with an increasing number of patients now using injectable devices that can be also monitored in a home setting – the market for wearable injectors capable of delivering high-volume biologics, which are another area of recent innovation, is set to grow by $4 billion over the next three years.7

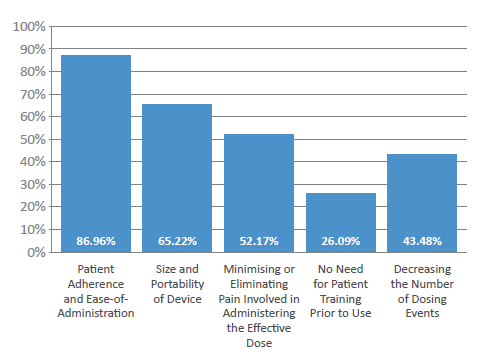

Figure 2: What are the main considerations when manufacturing patient-centric devices?

Understandably, the usability of devices has become a critical part of innovative medicines, with a shift in how companies are conducting R&D. Patient experience teams and real-world usability studies are now expected and no longer considered optional. The Pharmapack survey findings support this trend, with 78% of respondents stating that, with an increasing number of patients self-administrating drug therapies, “patient-centricity” is the most important factor in device design, particularly in terms of the need to “optimise safety and efficacy while minimising potential user errors”.

In fact, 87% of respondents cited “patient adherence and ease of administration” as the primary consideration when manufacturing patient-centric devices (Figure 2). Other key considerations highlighted included the “size and portability of the device” (65%), “decreasing the number of dosing events” (43%) and “limiting the need for patient training” (26%). One other important consideration highlighted by industry respondents was to minimise or eliminate any pain involved in administering an effective dose – consequentially, Pharmapack’s experts predict that patients will increasingly wish to switch to needle-free, painless injectable forms that are easy to use and disposable (particularly new patients).

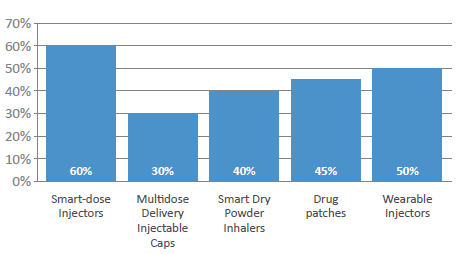

More widely, patient adherence has been an issue for many years, costing healthcare systems a significant amount across all chronic disease states. Therefore, is expected that a rise in the use of painless delivery (60%) will continue, with survey respondents identifying smart-dose injectors – those that can that confirm adherence – as the delivery form most likely to see double-digit annual growth in the next calendar year (Figure 3). Wearable injectors were also selected by half of the respondents as a device that will see double-digit growth, with drug patches (45%), smart dry powder inhalers (40%) and multidose delivery injection caps (40%) following. Significantly, the respondents reported strong percentages across all device types, which is perhaps a positive reflection of the likelihood of very strong growth in the next few years for all devices.

Figure 3: Which delivery form has the greatest potential for double-digit growth in 2022?

The case for smart devices continues to grow as, in addition to improved adherence, they offer the possibility for evaluation over a longer duration of time and not just in controlled hospital settings. Collecting real-time data empowers industry with data on real-world effectiveness against clinical efficacy. However, their use – primarily due to the high cost of introduction – will likely be limited to innovative medicines; they are, for example, unlikely to gain significant traction among biosimilar developers (Box 4).

BOX 4: EXPERT PERSPECTIVE ON CONNECTED DEVICES IN THE BIOSIMILARS SPACE

“Digitalisation is probably not going to have much of an impact for some time in biosimilars, because it completely goes against affordability and market access. This is on top of electronics that will require a dedicated infrastructure and, potentially, interoperability between patients, healthcare providers and pharma companies. I think connected devices are very much catered for innovative drugs – there is more incentive for their use especially where we don’t have much data on usage and adherence. However, if you have a biosimilar, you probably have a fairly good idea of what the clinical outcome is, what the work is of the treatment in terms of how and when the patients use it.”

– Dr Charbel Tengroth, Managing Director, Tengroth Consulting

CHALLENGES THAT COULD SLOW ADOPTION OF CONNECTED DEVICES

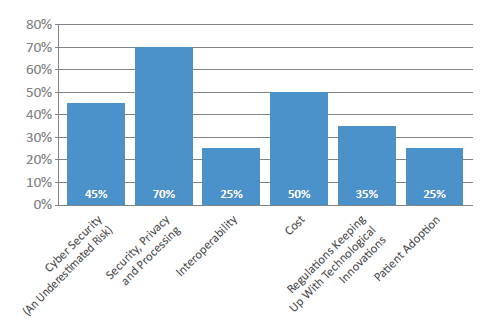

Figure 4: What is the biggest barrier facing connected devices and their widespread implementation over the next three years?

Interestingly, cost alone – the factor often blamed – was not seen by the industry as the main issue that could slow down adoption of connected devices. Instead, the complications around data security, privacy and processing were highlighted as potential issues that could hamper implementation in the next two to three years (Figure 4). This is an area of growing concern for both developers and pharma, as we have seen issues around hacking and, of course, devices must be interoperable with healthcare systems while simultaneously being compliant with regulations across regions. Pharmapack’s experts therefore predict that, over the next few years, the industry will attempt to move towards digital standardisation to offset some of the complexities these newer intelligent devices will bring in compliance. It is even possible that there will be a push for patients to have the ability to take direct control of their data.

THE DRIVE TOWARDS SUSTAINABILITY

While the covid-19 pandemic has captured the attention of the world, including the pharma industry, there is also another looming issue on the horizon – climate change. Pharma has begun a drive towards sustainability in the last five years, with an increasing number of companies looking to minimise their carbon footprint, reduce waste, lessen greenhouse emissions and lessen their reliance on plastics. One major sector that has come into focus is packaging, and while packaging in pharma is used less than in industries such as food and fast-moving consumer goods, most medical packaging is derived from polymers, and the majority of medical waste is disposed of via landfill.

BOX 5: EXPERT PERSPECTIVE ON SUSTAINABILITY

IN THE PHARMA INDUSTRY

“With the wide range of medicinal packaging platforms available, there is a large range of choice for patients and each platform has its own inherent sustainability index, which is usually measured as a CO2 equivalent value. Currently, there is no clear guidance on what standards the pharma industry should meet when it comes to sustainability. Healthcare providers and customers are increasingly asking about metrics regarding the carbon footprint of medical devices, medicines and packaging and this especially ties into the former’s own sustainability initiatives.”

– Gregor Anderson, Managing Director, Pharmacentric Solutions

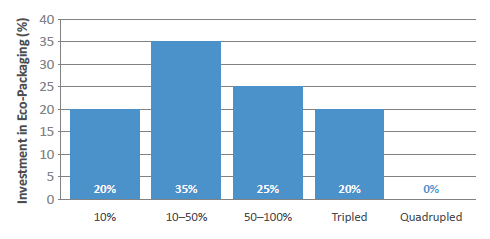

Governments are creating wider sustainability strategies across many industries, and pharma is no different, with a recent drive towards green chemistry initiatives to reduce the use of solvents in API manufacturing being just one example. Almost half of the survey respondents believed that investment in eco-packaging will increase by at least 50% within the next two to three years (Figure 5), and this will be largely driven by companies looking to lower their carbon footprint in line with the goals set out by the United Nations (Box 5).

Figure 5: In the next five years, by how much will investment in eco-packaging increase?

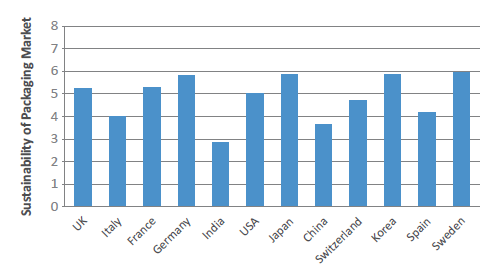

Figure 6: Packaging Sustainability Index 2021 (scores by country out of 10).

HOW DOES THE INDUSTRY THINK DIFFERENT COUNTRIES COMPARE FOR PHARMA SUSTAINABILITY?

Pharmapack’s new Sustainability Index (scored out of 10) – created to gauge the perception of how much is being done by each country in terms of plastic use, waste reduction, device recycling and progress towards sustainability – assesses how far along each country is in terms of achieving optimal sustainability of pharma devices and medicines among its population (Figure 6). Leading the Index in its inaugural year is Sweden (6.87), whose adoption of a strategy for a circular economy in 2020 has been key in their drive towards a more sustainable approach to packaging.8 To give just one example, Svensk Plaståtervinning (Motala, Sweden) has invested in building the world’s largest plastic recycling facility, Site Zero.9 The UK (6.04), which has implemented a tax on virgin plastic materials in disposable packaging, Germany (6.74), Switzerland (6.78) and France (6.09) are also all perceived by the industry to be leading Europe’s efforts in sustainability.

BOX 6: EXPERT PERSPECTIVE ON WORKING TOGETHER TOWARDS SUSTAINABILITY

“The whole pharma industry has to work together as an aligned partnership for solutions to be viable. This is because no single pharma company can tackle the bigger opportunities, such as recycling and standardising packaging materials and pack formats. With a joined-up industry roadmap, real change can be implemented, and this will need all stakeholders onboard. Green solutions should ultimately be a competitive advantage for all.”

– Gregor Anderson, Managing Director, Pharmacentric Solutions

While both the governments of India and China have made sizeable efforts towards reducing carbon and environmental impacts of their pharma industries, the market has yet to be convinced, with India (3.30) and China (4.22) having the lowest perception scores by some distance. Also of note is that this is the only Pharmapack metric where the US ranks lower than the majority of European nations. Pharmapack surmises that this is likely due to the US’s weaker governmental commitments, rather than a reflection of the relative commitment to sustainability of US-based drug device companies. However, the expert takeaway from this assessment has been that, in order for the industry to transition to a greener future, the global pharma industry should work together (Box 6).

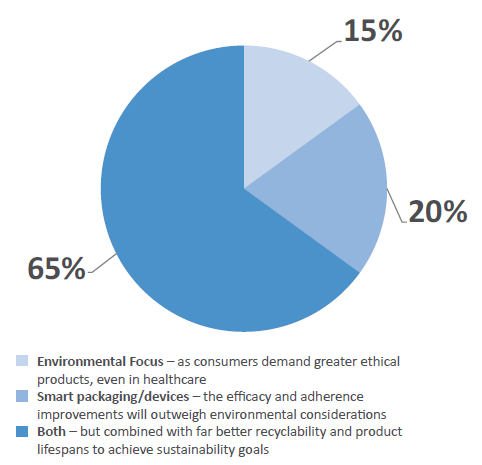

Figure 7: The two dominant trends “smart packaging/devices” and “environmental/green packaging” are often diametrically opposed. Which do you think will have the biggest bearing on product development over the next three years?

However, the two dominant trends – smart packaging and green packaging – are often diametrically opposed in practicality, as smart devices tend to be less recyclable. However, an encouraging 65% of survey respondents believed that both can co-exist (Figure 7). The majority of the industry believes that “a shift towards better recycling and improved product lifespan” will help integrate sustainability goals without compromising device adoption over the next three years. However, 15% believe that consumer demands will take precedence, demanding that more sustainable and ethical products be used, while 20% believe that smart packaging will prevail as patient efficacy and adherence improvements will outweigh environmental considerations for now.

CONCLUSION

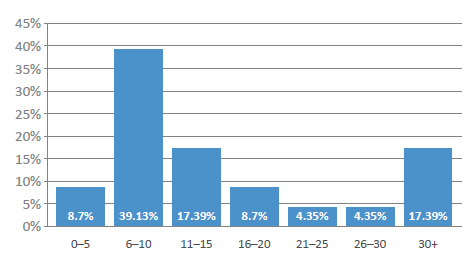

One consequence of the pandemic is that novel drug delivery device innovation – outside novel injectors – was temporarily slowed and, as the industry returns to normality, we can expect a rise in new devices throughout 2022 (Box 7), with over half of the industry representatives surveyed expecting more than 10 new device approvals in 2022 (Figure 8). Significantly, future covid-19 vaccines will further increase the demand for injectable devices, and the pandemic has also clearly shown the benefit of both connected and self-use devices.

Figure 8: How many novel drug delivery devices or platforms will be approved by the FDA in 2022?

Pharmapack anticipates that innovation in devices will accelerate post-pandemic and that device manufacturers and pharma companies will increasingly collaborate to use them in conjunction with other digital assets, including apps, smartphones and computers. Ultimately, this will give patients far greater control over their own care. In the medium term, Pharmapack anticipates these efforts to start aligning with much wider access to recycling schemes so that patient adherence, which is inherently green, since it seeks to optimise the use of medicines, and sustainability gains can be made in tandem alongside therapeutic improvements.

BOX 7: EXPERT PERSPECTIVE ON THE NEXT BIGINNOVATIONS IN DRUG DELIVERY & DEVICES

“There is a lot of benefit for patients that are taking a drug long term to not have to inject each time. Implanted systems that can slowly release a drug would be great, however, they don’t really exist at the moment. Despite this, oral insulin may be nearer to becoming a reality than it was 10 years ago, and developments such as in-body implanted systems, which generate insulin are definitely growth areas.

Ocular delivery is also an area that could see more innovation in the near future, focusing on drug delivery across the blood-brain barrier to improve how quickly it gets into the system. For a while this approach appeared to fall out of fashion, however, it is beginning to be considered again as a key way to deliver into the blood. Such an approach would be particularly helpful in chemotherapy for example, as when these drugs are delivered orally or via injection, they can be harmful as they affect more than just the targeted area. Direct intra-tumoral delivery would be a brilliant breakthrough for cancer treatment, however, there are a lot of hurdles to overcome before this can be achieved, such as further developments in highly focused, targeted drug delivery.”

– Brennan Miles, Managing Consultant, Drug Delivery, Team Consulting

– Dr Stephen Blatcher, Head of Early Stage MedTech, Team Consulting

However, the pandemic has also altered perceptions and expectations, exemplified by the increasing number of people who are now self-administrating. As this becomes the norm, companies are likely to make the patient experience the central component of drug delivery device design. Potentially emerging from this trend – in combination with connected devices – will be the use of real-time data to ensure that patient treatment can be evaluated over a longer time period, in pursuit of increased compliance. In terms of the annual Pharmapack Innovation Index, it has been another good year for the industry, with respondents raising the overall index by nearly 2%, and India making sizeable gains and the US leading once again. Yet, in an industry so used to US leadership, sustainability goals are, in the industry’s opinion, currently being driven forward by European nations. The EU’s bloc-wide ability to regulate is pressing the industry to re-evaluate the materials it uses, but also, how to reliably collect and recycle these devices when, historically, virgin materials have been not only preferred but required. Pharmapack anticipates that the total lifecycle impact of devices will be talked about as the primary metric in two- or three-years’ time.

Over the next few years, Pharmapack also expects medicine delivery to become more efficient as patients gain greater digital tools. However, sustainability goals may also see these very same digital tools being used to empower patients to be part of the solution by using reminders, maps and instructions on how, when and where to responsibly dispose of packaging waste and used devices.

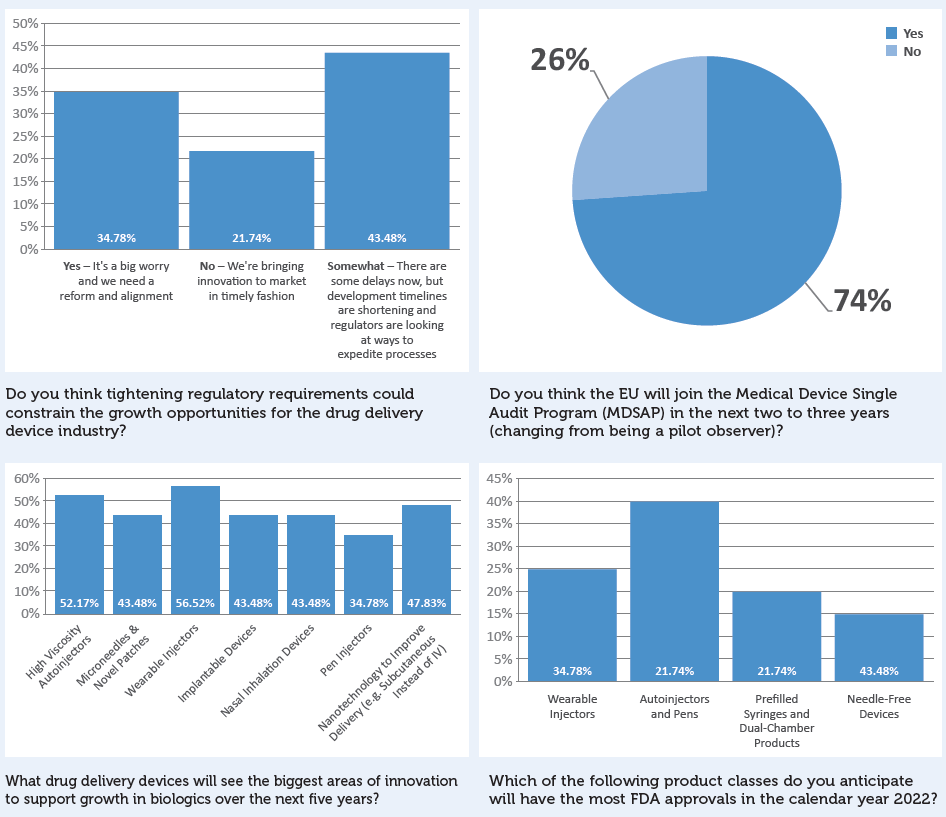

Additional survey results not directly referenced in this article are presented in Box 8.

BOX 8: ADDITIONAL SURVEY RESULTS

ABOUT PHARMAPACK

Launched in 1997, Pharmapack is a Europe-based conference for pharmaceutical packaging, drug delivery and medical devices and machinery. Pharmapack started as a biannual conference and exhibition, taking place every other year in Paris, France, until industry developments demanded a more frequent event to help the industry stay up to date on the latest trends, developments and regulations. In the past 24 years, the event has grown from a conference with a small table-top exhibition to an event hosting over 410 exhibitors and welcoming attendees from 75 different countries over two days.

REFERENCES

- Choudhary S, Shinde S Sumnat O, “Pharmaceutical Packaging Market by Product Type: Opportunity Analysis and Industry Forecast, 2020–2027”. Allied Market Research, Jan 2021.

- Wiggins K, Mooney A, Barnes O, “Vectura Investors Under the Microscope as Philip Morris Hunts Victory”. Financial Times, Aug 2021.

- Mallapaty S, “India’s DNA covid Vaccine is a World First – More Are Coming”. Nature, 2021 Vol 597(7875), pp 161–162.

- hanna A, “Covid-19 and R&D Tax Credits: Tap Into India Incentives”. Bloomberg Tax, May 2021.

- “HIMSSCast: Are Digital Therapeutics the Future of Mental Health?”. MobiHealthNews, Aug 2021.

- “Europe Drug Delivery Devices Market Research Report – Industry Analysis, Size, Share, Trends and Growth Forecast (2021 to 2026)”. Market Data Forecast, Apr 2021.

- “Wearable Injectors Market by Product and Geography Forecast and Analysis 2021-2025”. Technavio, Nov 2019.

- “Sweden Transitioning to a Circular Economy”. Government Offices of Sweden, Jul 2020.

- Corbin T, “Sweden’s Site Zero to Become ‘World’s Largest Plastic Recycling Plant’”. Packaging News, Sept 2021.