Citation: Jung B, “The Future of Connected Asthma and COPD Care: a Network Perspective”. ONdrugDelivery Magazine, Issue 98 (Jun 2019), pp 18-22.

Benjamin Jung uses a network theory approach to look at the ongoing issue of adherence when it comes to the treatment of asthma and COPD, and the players involved in overcoming it.

Adherence to asthma and COPD medication continues to be a problem,1 with a substantial number of patients not gaining the maximum treatment benefit – which leads to avoidable hospital admissions and even deaths.2,3 In addition, the economic burden associated with this situation is significant.4,5,6

“Patients increasingly demand connected

health solutions via their advocacy groups.”

During the introduction of connected devices into asthma and COPD care, which is on its way, one question remains a focal point of discussions with key stakeholders: How will the network of players within connected asthma and COPD care evolve and what implications does this have when it comes to today’s decisions and actions? To foster these discussions, this article employs a network perspective7 on the major stakeholders within connected asthma and COPD care, as well as on the ties they have already established. The article further discusses possible implications for H&T Presspart and our key partners – our pharmaceutical customers.

KEY STEPS TOWARDS A NETWORK PERSPECTIVE

The network theory is becoming increasingly popular in management science and consulting. In a nutshell, it describes the characteristics of networks and discusses resulting consequences, like the consequential flow of data. A network consists of actors (nodes), which have relationships (ties) amongst themselves. A prominent concept within network theory is centrality, which maps out advantages of being connected to well-connected nodes.7

In line with common network logic,we will:

- Start with describing major actors within connected asthma and COPD care

- Then discuss ties in terms of partnerships and business relationships between them

- End with compiling potential implications based on consequences from the network, like the flow of data.

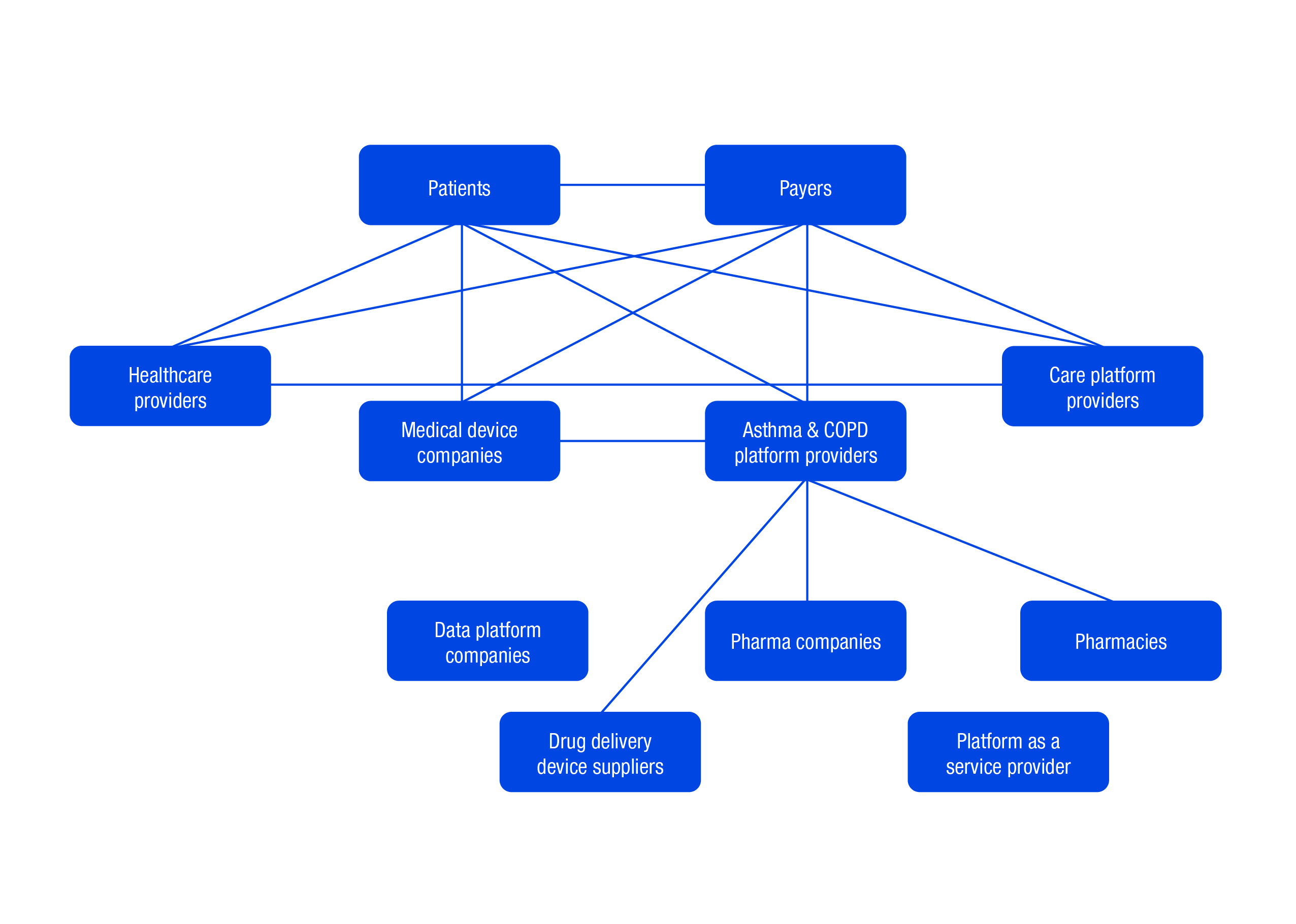

Figure 1: Connected asthma and COPD care network.

MAJOR ACTORS WITHIN CONNECTED ASTHMA & COPD CARE

To describe major actors within connected asthma and COPD care efficiently, we will subsume whole groups of stakeholders under individual actors, focus on the actors we deem major and concentrate the analysis on the two major markets – Europe and the US. Of course, this is just our perspective. Hence, for example, some of the individual stakeholders listed might recognise themselves as belonging to a different group of stakeholders.

“The number of established ties of pharmaceutical companies within connected asthma and COPD care is rather small.”

From our perspective, the major actors are:

- Patients, who increasingly demand connected health solutions via their advocacy groups, as these solutions – largely based on recorded data around their device usage – can help them to improve medication compliance.

- Payers, differentiated into state-owned and private entities. They show a very diverse approach when it comes to connected care. Some are rather at the forefront, shaping the change. Others are more short-term budget driven and hence not leaning towards preventative spending – even if it can provide significant savings.

- Established healthcare providers, which includes a broad set of players like hospitals and physicians.

- Pharma companies producing and marketing inhaled drugs for asthma and COPD like beta2-agonists, muscarinic antagonists, inhaled corticosteroids and their combinations. Examples for leading originators in the space are GSK, Boehringer Ingelheim, AstraZeneca, Novartis, Teva and Chiesi. These players have a particular interest in anonymised, real-life patient use and outcome data, as it can foster R&D.

- Drug delivery device suppliers producing metered dose inhalers, dry powder inhalers and soft mist inhalers and/or their respective componentry like H&T Presspart and our peers, e.g. 3M and Aptar.

- Medical device companies typically producing and marketing medical devices like nebulisers, spirometers and continuous positive airway pressure (CPAP) devices. Prominent examples within connected asthma and COPD care are Philips Healthcare and ResMed.

- Pharmacies dispensing drugs to patients.

- Asthma and COPD focused providers of connected platforms, which typically encompass a mobile front end, cloud-enabled services and a database. These companies are often start-ups and tend to market add-ons devices, which are – as far as the inhaler design allows for – generic. This means they can be used with different drugs. Examples are Cohero Health, Propeller Health and Adherium. We will call these players asthma and COPD platform providers.

- Non treatment area specific, more general health platform providers. These players tend to focus on cloud-enabled services and the underlying database, rather than on the mobile front end. The activities and respective companies which can be subsumed here are very diverse. They range from the respective activities of the tech giants (e.g. Alphabet, IBM and Apple) to the platform activities of companies such as Phillips-Medisize and Flex. Also, the activities of health record vendors like EPIC fit here. The major aspect to split this diverse group at least into two actors is their approach: some seem to rather have a service provider mindset enabling, for example, pharma companies “to be connected”. Others likely aim to build ties to various players proactively and to gather a huge amount of data and therewith value. We will name the resulting actors platform as a service providers and data platform companies.

- Care platform providers, which aim to holistically monitor patient subgroups and which are using connected solutions and underlying data sets as a key enabler to do so. An example is Care Innovations.

Figure 2: H&T Presspart’s eMDI™ powered by Cohero.

Of course, this list could be extended significantly. The following could also be added but have been left out for the purposes of this analysis: regulatory bodies, other policy makers, electronic manufacturing services, electronic component suppliers (e.g. of sensors and chips), pharmacy benefit managers, wholesalers, health systems, design houses, international organisations (e.g. the WHO), specific data providers (e.g. of air quality data), hospital-focused platform providers, software technology providers, server hosts and cloud service providers, consumer/OTC-focused players, patient advocacy groups, employers and so on.

ESTABLISHED TIES WITHIN THE CONNECTED ASTHMA & COPD CARE NETWORK

We will now describe the ties between the major identified actors. We will focus on the partnerships and business relationships between them, which are public, are rather broadly established and have a connected asthma and COPD care edge. Partly due to the strongly confidential nature of activities in our industry, various ties that already exist may be neglected. This is acceptable, as relationships not yet made public, on average, are less established.

As of now, the major ties from the payer’s perspective are to:

- Healthcare providers, the Current Procedural Terminology codes for remote patient monitoring introduced in the US being a great example

- Care platform providers, the telehealth efforts in Mississippi – including Care Innovations – are an illustrative case8,9

- Asthma and COPD platform providers, where the relationships of Cohero Health and Propeller Health to Blue Cross Blue Shield companies were made public

- Medical device companies, where the reimbursement of ResMed’s connected CPAP devices represents a good example.

Patients have established a comparable set of ties: especially to healthcare and care platform providers within telehealth and remote patient monitoring efforts. Furthermore, asthma and COPD platform providers and medical device companies market their solutions directly to patients. Adherium and Cohero Health launched direct-to-consumer solutions. Also, patients can directly register for ResMed’s myAir™ online. Patients and payers are, of course, also closely connected, especially when it comes to private payers.

Between the actors being identified as connected to patients and payers (healthcare and care platform providers, medical device companies, and asthma and COPD platform providers) major ties at least exist:

- Between medical device companies and asthma and COPD platform providers (after the acquisition of Propeller Health by ResMed)

- Between healthcare providers and care platform providers (as within the telehealth example cited).

So, the following question needs be raised: How are the remaining actors being connected to the dense sub-network identified so far and what kinds of ties have they established between one another?

The major ties out of the sub-network of patients, payers and medical device companies as well as healthcare, care platform, and asthma and COPD platform providers, are the ties from asthma and COPD platform providers to drug delivery devices suppliers, pharma companies and pharmacies. Good examples are the collaborations of Cohero Health with H&T Presspart, and of Propeller Health with Walgreens and Novartis.10,11

When it comes to ties among the remaining players (pharma companies, drug delivery device suppliers, platform-as-a-service providers, data platform companies and pharmacies), we believe, at least based on publicly available information, no ties have yet been established broadly.

POSSIBLE IMPLICATIONS RESULTING FROM THE NETWORK PERSPECTIVE

The resulting network is illustrated in Figure 1. It shows the close-connected sub-network of patients, payers and medical device companies as well as healthcare, care platform, and asthma and COPD platform providers. In addition, the limited ties from the remaining actors into this sub-network and between themselves are illustrated. It becomes clear that data platform companies, as well as platform-as-a-service providers, seem not to have established ties yet.

Figure 3: H&T Presspart’s Quantum™ app.

Let’s look at the actual connected asthma and COPD care network described and illustrated in Figure 1, in combination with the possible implications for our key partners – pharmaceutical companies. First of all, it seems fair to state that the number of established ties of pharmaceutical companies within connected asthma and COPD care is rather small so far compared with other actors. Based on the analysis, they also do not appear to be centrally located within the network as of now. From a network perspective7 this implies that:

- They potentially receive usage and outcome data, which emerges from patients, but also the financial streams emerging from payers later

- Their negotiation position towards players, being more closely connected to patients and payers, is potentially challenged.

This actual positioning of pharmaceutical companies within the network might, at least partly, be traceable back to the following aspects:

- The data platform companies are not positioned clearly yet within the network

- The emergence of a central data player within healthcare is not unlikely, looking at the situation in other networks like retail and communication

- The handling and use of real-life patient use and outcome data has, at any point, to be in line with globally diverse, as well as dynamically evolving, data legislation.

Nevertheless, in line with the perspective chosen, building ties to more actors, especially establishing more direct ties to patients and payers, seems critical. Also, doing so via your own connected solutions – consisting of embedded devices and customised platforms with interoperability – is key. These solutions likely offer:

- A path towards reimbursement of digital therapeutics bundled with pharmaceuticals, which is an emerging reimbursement pattern in other treatment areas

- More control over data usage.

“Connected solutions consisting of embedded devices and customised platforms embracing interoperability are key for pharmaceutical companies.”

Also, partnerships with other pharmaceutical companies within connected care might be supportive. This pattern is seen within the automotive industry as it progresses towards electric cars and autonomous driving.

From H&T Presspart’s standpoint, comparable implications could be derived from a network perspective, e.g. establishing more direct ties to patients and payers. But that is not our business model.

H&T PRESSPART’S eMDI™ POWERED BY COHERO

H&T Presspart aims to enable its pharma partners with its connected devices and with the relationships we build to shape the network. Hence, H&T Presspart and Cohero Health formed a collaboration and, as a result, the first market-ready, fully embedded, intuitive, connected metered dose inhaler was created: The H&T Presspart’s eMDI™ powered by Cohero (Figure 2).12,13

The eMDI device’s connective hardware and software are fully embedded within the actuator design. The actuation of the inhaler and the patient’s actuation technique are detected by the electronics with the aid of switches. Then a date/time stamp is added and the data shared wirelessly via Bluetooth Low Energy (BLE) with a mobile phone application – the BreatheSmart® application from Cohero Health. If desired, sharing with other applications is possible and additional features like flow rate measurement can be added.

H&T PRESSPART’S QUANTUM™ DOSE INDICATOR AND APP

H&T Presspart’s Quantum™ dose indicator and the respective app interface represent a comparable tool. It aims to give pharmaceutical customers in emerging markets the opportunity to shape the connected asthma and COPD care network. The off-the-shelf Quantum™ dose indicator is an on-can metered dose inhaler indicator solution, ensuring patients don’t run out of medication. This is achieved with the aid of an arrow located at the bottom of the can indicating the remaining drug level.

The Quantum™ dose indicator app (Figure 3) can be used to read this arrow almost automatically. The device usage can thus be tracked via combining the can-filling level data gathered during individual arrow readings. Last, but not least, the functionality of the Quantum dose indicator app can be incorporated into a comprehensive respiratory disease management platform to offer additional functionalities, for example data sharing with physicians.14

CONCLUSION

Analysing the connected asthma and COPD care network, pharma companies seem to not yet be centrally located. Taking on a network perspective and having payers moving from funding medicines to funding care, this position likely comes with disadvantages. Building direct ties to patients and payers seems critical. Therefore, own connected solutions consisting of embedded devices and customised platforms embracing interoperability are key for pharmaceutical companies. With our connected devices and adjacent solutions, H&T Presspart aims to support our pharmaceutical partners across the globe to become the key players within connected asthma and COPD care.

REFERENCES

- “Smart inhaler for asthma – Medtech innovation briefing”. NICE, 2017.

- Williams L et al, “Relationship between adherence to inhaled corticosteroids and poor outcomes among adults with asthma”. J Allergy Clin Immunol, 2004, Vol 114(6), pp 1288-1293.

- Levy M et al, “Why asthma still kills – The National Review of Asthma Deaths (NRAD)”. Research Report, Royal College of Physicians, August 11, 2015.

- Ford E et al, “Total and state-specific medical and absenteeism costs of COPD among adults aged ≥ 18 years in the United States for 2010 and projections through 2020”. Chest, 2015, Vol 147(1), pp 31-45.

- “Asthma in the US”. CDC.

- Gibson G et al, “The European Lung White Book: Respiratory Health and Disease in Europe”. European Respiratory Society, 2013.

- Borgatti S, Halgin D, “On Network Theory”. Organization Science, 2011, Vol 22(5), pp 1168-1181.

- “Mississippi Telehealth Network ‘Leads the Nation,’ Says Governor”. Care Innovations blog.

- “Intel-GE Care Innovations and University of Mississippi Medical Center to Extend Groundbreaking Remote Care Management Program”. Press Release, Care Innovations, November 10, 2015.

- “Propeller Health announces My Pharmacy, enabling in-app pharmacy experience for patients with asthma and COPD”. Press Release, Propeller Health, January 9th, 2019.

- “Propeller Health Enters into Collaboration to Connect Breezhaler™ Devices to the Propeller Platform”. Press Release, Propeller Health, February 8, 2017.

- Jung B, Shears D, “Embedded connected metered dose inhalers meeting requirements for mass adoption”. ONdrugDelivery Magazine, Issue 76 (June 2017), pp 44-48.

- Jung B, “The Future of Connected Asthma and COPD Care: A Stepwise Approach”. ONdrugDelivery Magazine, Issue 87 (June 2018), pp 18-22.

- Meyer I, Wilson K, “Dose Counters and Indicators – Meeting a real patient need”. ONdrugDelivery Magazine, Issue 74 (April 2017), pp 24-28.

Previous article

DON’T DEVELOP A CONNECTED DRUG DELIVERY DEVICE WITHOUT READING THISNext article

MIRCEA DESPA & DOUG McCLURE, BD