To Issue 156

Citation: Keldmann T, “Interview – A Symbiotic Relationship Between Drug Delivery Device Systems and Pharma”. ONdrugDelivery, Issue 156 (Jan 2024), pp 18–21.

Troels Keldmann discusses the significance of the drug delivery industry, its relationship to pharma, the challenges it faces and how the pharma industry is shaping the drug delivery device field.

“When we are successful in this industry, then the delivery systems are accurate and convenient, resulting in compliance and adherence to therapy.”

Q Why is the drug delivery device industry an important industry?

A To me, drug delivery device systems (DDSs) are where the drug meets the patient and the healthcare professional (HCP). Identifying the correct drug dosing and delivery route ensure that efficacy and safety are realised for the patient. However, there is more to it. When we are successful in this industry, the DDSs are accurate and convenient, resulting in compliance and adherence to therapy. We get the intended therapeutic outcome for patients and the best commercial outcome for the pharma company. So, I see both a technical and commercial side to why our industry is important.

A DDS can be the technological “enabler” for a drug, but it can also be the element that differentiates “similar drugs”. These two aspects drive the need for innovation. Often, device development and manufacturing are not internal Interview competencies within pharma companies. This creates a need for external innovation and manufacturing. The drug delivery device industry fulfils that need.

Our industry has become significant. Alone, the global injectable drug delivery device market size was estimated at a value of more than US$15 billion (£11.8 billion) in 2022. And, more broadly, if you include inhalation and transdermal delivery devices, for example, the global market size is estimated to be over $39 billion. In my view, the industry is attractive due to the market size, unmet needs in new therapeutics and improvement opportunities for acute and chronic patients.

Q Please describe how you became involved in this sector?

A My way in was a bit different to others I have met in our industry. I did not go directly into injectable drug delivery, but had an entry in inhaled delivery, coming from the role of an innovator.

I grew up in a family of innovators and entrepreneurs, so spotting unmet needs and addressing them was a part of daily life. My family responded with interest when a distant family member directed our attention to unmet needs in asthma inhalers. At that time, I was studying engineering at university. At first, it was a spare-time project , and stayed that way for several years, but it evolved into a spin-out company from the family business. After completing my PhD in Product Innovation, I committed myself to lead the spin-out. So, at a young age, I became an innovator in this industry. We created a unique, patented device technology platform for pulmonary and nasal delivery. Thirteen years later, we completed an industry sale exit to a North American specialty pharma company.

During those years, we matured the two device technologies and advanced a portfolio of three generic asthma drugs into clinical trials in a pharma partnership. I learned how to blend hands-on DDS technology maturation with strategic commercial thinking on applications and intellectual property rights (IPR)-based commercialisation in pharma deals.

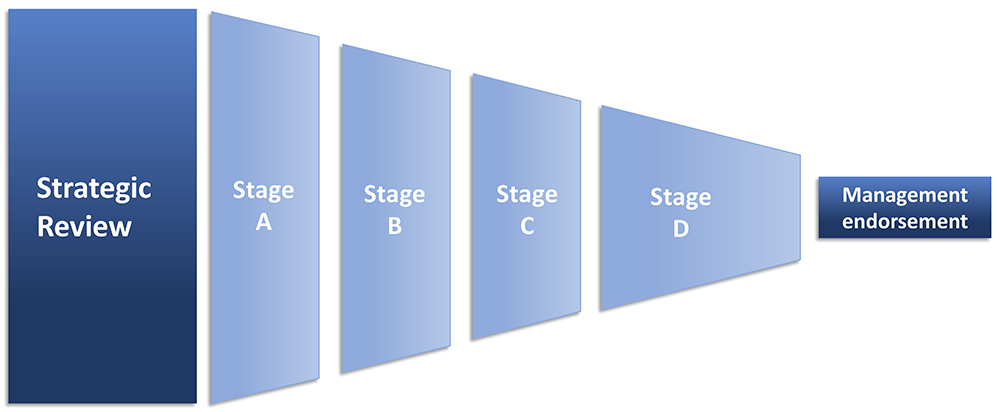

After the industry sale, I directed my attention to DDSs for injection. This has included consulting tasks on device commercialisation and a management role in a venture capital-backed injection device start-up. Later, I took up longer-term consultant roles in corporate pharma with a focus on strategic review and selection of injection devices and suppliers (Figure 1). On top of that, I am a Business Coach for technology innovators in the EIC Accelerator programme under EISMEA. In that role, I have coached injection device innovators.

Figure 1: Strategic review to endorsement in six steps.

I am experienced on both sides – innovator and corporate. I bridge technical and commercial perspectives, and I work at cross-functional and cross-management levels. My experience enables me to work hands-on with an executive’s mindset.

“The availability of digital tools is an important enabler, which will likely impact the injection systems.”

Q What do you see as the two to three main current or emerging trends in pharma, and healthcare more broadly, that are going to shape the injectable drug delivery space over the coming years?

A In the general picture, I have noticed that biological treatments are increasing and current pharma R&D pipelines indicate that a continued rise in the number of available treatments is likely. These therapies are costly, which will be challenging for healthcare systems that are already affected by increasing costs. So, paying attention to value-based healthcare is logical – from the initial drug–patient match to any later follow-up on actual outcomes. In my view, the new opportunities in digital tools and artificial intelligence will be important enablers, but will still require approval, endorsement and adoption among HCPs and patients. The general societal awareness of environmental sustainability will also have an impact on the DDS sector.

Specifically for the injectable drug delivery space, biologicals have clearly influenced DDS R&D, especially in the development of large-volume injectors. Significant attention is being directed towards larger-volume injectors and the liquid properties of biologics, notably their higher viscosity, which is even higher under cold storage temperatures. All this leads to longer injection times. So, the concept of on-body and wearable injectors has spread.

We have not yet seen wide implementation of these device solutions to the extent expected a few years back. In my view, part of the explanation may be that, in many indications, marketed biologics are first or second in class. The drug itself is a strong differentiator. This means that the pharma companies prioritise the earliest possible product launch to capitalise on their drug asset to the greatest extent possible. I believe that this explains why prefilled syringes and autoinjectors are preferred by pharma. This may change when differentiation of the drug efficacy and safety becomes insufficient by itself. In that case, both lifecycle management of successful drugs and new drug launches of “similars” will focus on product differentiation by the DDS. In my opinion, that could bring renewed opportunity for alternatives to the currently used injectable delivery systems.

Biologic therapies are costly for healthcare systems, so the focus on patient outcomes, compliance and adherence will increase. The availability of digital tools is an important enabler, which will likely impact the injection systems. Either these digital solutions will be applied for data capture in clinical trials or tools will be added for general use with the launched drug product. It is logical to consider the ways in which these tools can be integrated or combined with the DDSs. Digital tools and innovation are still considered “external innovation” by pharma companies. So, in my view, the DDS industry has the opportunity to take the “integrator role” when linking digital tools and the delivery device in clinical and commercial use cases.

The environmental sustainability agenda will also influence the industry, if not by direct regulation, then by pharma and device companies applying their own environmental policies to their operations. If you attend conferences, then many insights are being shared through lifecycle analysis (LCA) of injectable delivery systems. I know from dialogue with LCA specialists that the challenge is how you frame your analysis – either as a specific part of the product lifecycle or the “largest picture”. Currently, attention is on energy and materials (recycled, reusable, recoverable). From an environmental perspective, there are different implications with injectors using different types of power source: mechanical spring, gas container, battery and electro mechanical, osmotic force, etc. In my view, choosing device solutions with a significantly high environmental impact may soon require explainable justification.

Q In your experience, how well does pharma communicate its DDS requirements to the devices sectors? Likewise, how well is the DDS industry aligned to pharma’s requirements?

A My experience is that most pharma companies are able to state what they are looking for when you ask them. Especially when you are in close dialogue with the central people in R&D or Commercial. It may be necessary to communicate under a non-disclosure agreement (NDA), the reason being that key device specifications may mirror confidential characteristics of the drugs in development or the company’s confidential strategic priorities on device technology. Mostly, I find that pharma companies prefer that device companies share device characteristics, performance intervals and customisation dimensions. On that basis, pharma companies will consider the relevance of requesting test samples for their own evaluation, or they may request specific feasibility tests to be performed by the device company. The scope is two-fold on the pharma side – searching for technology with specific characteristics and scouting for novel and potentially future-relevant device technologies.

Regarding alignment with pharma needs, my opinion is that a wide range of DDS technologies with different performance and use characteristics are available. However, besides the device performance parameters, there are additional aspects such as technology maturity, IPR and freedom to operate, fit with preferred primary packaging, a supplier’s track record and supply cost. The ideal device solution from an application perspective for the pharma company may not readily meet the additional key criteria. Consequently, the matching of pharma needs with device technology may be a longer process.

“The deeper your dialogue with pharma, the more internal stakeholders will be involved in the evaluation of your innovation.”

Q What challenges do you see for device innovators when selling to pharma, and how can device companies overcome these challenges?

A Generally speaking, it is challenging to be an innovator. Access to the right people in the targeted pharma company is key. The Commercial or R&D departments are often the preferred contact points, although Business Development is a reasonable alternative. Having had prior contact at conferences or on other occasions is a significant advantage that can ease the process. Here, the long-established device companies – with a track record of prior contact and approved and marketed innovations – often face less of a challenge.

The perceived relevance and uniqueness of your innovation will determine the attention you receive. Your value proposition has to be clear and quantified. You need to reveal enough about your innovation to establish sufficient interest and demonstrate willingness to enter an NDA.

You will benefit from having a visualisation of your ideal use cases where all the unique characteristics of your innovation are impactful. Explain the difference between your innovation and the current reference solutions and back it up with data. Novelty requires high attention to communication.

The deeper your dialogue with pharma, the more internal stakeholders will be involved in the evaluation of your innovation. The range may include R&D (e.g. device, formulation, primary packaging, human factors engineering, drug programme), commercial (e.g. marketing, sales), regulatory affairs, quality assurance, manufacture (e.g. MSAT), procurement and IPR. The challenge is that gaining support from all stakeholders is important. So, the most convincing approach is to craft information packages for each type of stakeholder. Ideally, these packages should be both convincing and self-explanatory, which can be a serious challenge. You will be assigned a key contact person, who, ideally, will be championing your innovation inside the pharma company. With self-explanatory packages, the internal review will be less dependent on the expertise and availability of your key internal contact.

Pharma companies often prefer to engage with device innovators with a proven track record, including for device manufacturing capacity. For smaller and younger innovator companies, I would recommend teaming up with an established contract development and manufacturing organisation. This will strengthen your credibility in any dialogue with pharma.

As I’ve already stated, access to the right people is important, but timing is also very important – matching up with an R&D pipeline, prioritised disease areas, product lifecycle management and the pharma company’s general competitive situation. These are challenging factors that are out of your control. So, it is essential to establish contact and remain in contact with pharma, even over longer periods. At some point, the timing may become right for your innovation. Also related to timing, it is important that you make your innovation visible and findable for those who perform technology searches. Industry publications, conferences and online platforms are ideal for showcasing your innovation. ONdrugDelivery has been instrumental in my work on commercialising drug delivery technology.

“Obviously, the device is central in the user experience for patients and HCPs, so the usability and human factors are key elements – especially if the device is to be used by different patient categories.”

Q What challenges do you see for pharma companies deciding on injection devices and how can they overcome these challenges?

A Device selection may appear to be a straightforward task. But, when you dig into the implications of device selection, it is clearly a strategic decision. Even more so if you intend multiple drugs to share a single device platform. Matching the device’s technical performance parameters with the drug’s dosing and liquid characteristics is a basic exercise, but any need for device development and adaptation may impact overall drug programme-related timelines and risk. The device may have compatibility issues with specific primary packaging, as well as with the preferred fill-finish lines (either internal or with a contract manufacturing organisation). Obviously, the device is central in the user experience for patients and HCPs, so usability and human factors are key elements – especially if the device is to be used by different patient categories. Finally, the device is likely to be used for a significant period of the drug’s time on the market. So, the device selection also means entering into a supplier–development relationship that is expected to last for long time – ideally, a productive and robust partnership based on trust, collaboration, competence and capacity. This aggregate set of aspects is complex and has long-term impact, so you need these decisions to align with broader corporate goals and long-term strategies. In my view, this requires a structured and systematic approach to device selection.

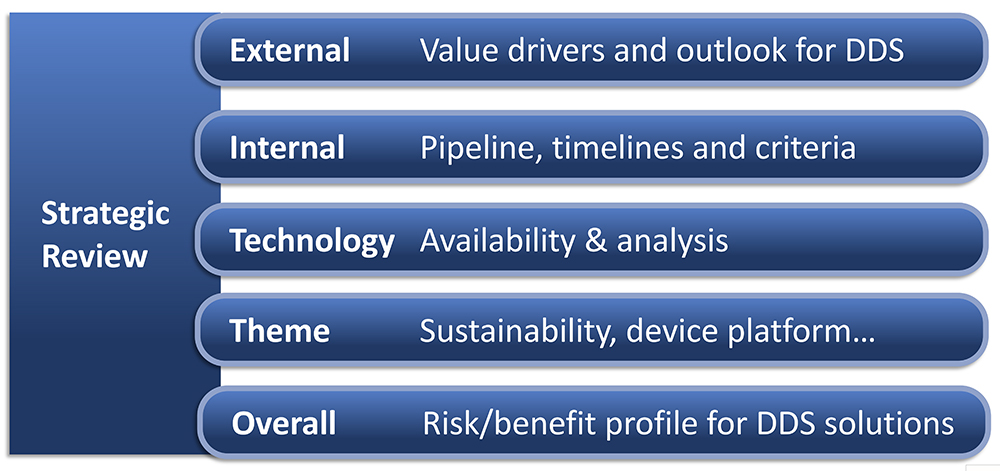

In my experience, there is value in any prior internal work on device selection. So, build upon existing knowledge and expertise – such as from your collection of information, analysis and prior decisions. If the right strategic clarifications are in place and all device selection criteria are defined, then you can move into a funnel of steps where device alternatives are evaluated. If these aspects are not in place, then you need a device strategy process where cross-functional teams collect and extract information for strategic analysis. Generally, there will be an internal analysis, external analysis and technology analysis (Figure 2). The technology analysis should include availability and trends, IPR situation, timelines for device development and adaptation, costs and risks; the external analysis should focus on user preferences, regulatory requirements, competition and future trends; and the internal analysis should include pipeline, timelines, competences, resources and necessary alignment with business strategy.

Figure 2: Five work streams in strategic review.

Internal stakeholder involvement and management is key in both the strategy process and the later funnel of device-selection steps, so cross-functional involvement is critical. I use visualisation tools and diagrams to ease the understanding of the most complex issues, which are also useful when sharing and discussing across management levels up to C-suite. Be diligent on taking minutes in meetings – it will help you keep momentum during the process of reaching a final selection and recommendation to management.

This brings me back to the earlier question of the importance of the DDS industry. When we pair the right drug with the right device, then it results in both the intended therapeutic outcome of drugs for patients and the best commercial outcome for the pharma company. This is key to my motivation for my consulting work with device innovators and suppliers and with pharma on DDS projects.